Political commentary and analysis of current Texas Policies. Focuses on pending legislation with action alerts. Applies a “Follow the Money progressive approach” to local and state officials' roles in public policy.

Tuesday, July 24, 2007

PREMEDITATED MERGER - Controversy erupts over leaser of U.S. toll roads

By Jerome R. Corsi - © 2007 WorldNetDaily.com - July 20, 2007

Investment analysts in New York and Australia charge that Macquarie, the Australian conglomerate leasing U.S. toll roads, is a "house of cards" that has made billions by spinning off the highway assets into over-valuated investment trusts controlled by the bank.

Macquarie has been an active participant in the "public-private partnerships" sponsored by Mary Peters when she was head of the Federal Highway Administration.

As documented on the FHWA website, Macquarie recently concluded long-term leasing deals on the Chicago Skyway and the Indiana Toll Road.

In both projects, Macquarie has partnered with Cintra Concesiones de Infraestructuras de Transporte, S.A., the Spanish investment consortium also involved in financing and leasing the Trans-Texas Corridor.

The criticism of Macquarie can be traced to a paper published last year by John L. Goldberg, an honorary associate at the School of Architecture, Design Science, and Planning at the University of Sydney in Australia.

Titled "The Fatal Flaw in the Financing of Private Road Infrastructure in Australia," the paper argued equity investors in Macquarie investment trusts are likely to suffer heavy losses by excessive valuations Macquarie makes of financed toll roads that are packaged together to be sold to pension funds and other institutional investors.

Goldberg also argued that government guarantees on Macquarie projects are often buried in the confidential part of toll road "comprehensive development agreements," such that the public taxpayer liability only comes to light when a toll road project fails.

Jim Chanos, a founding principal in the New York investment firm Kynikos Associates, has been equally critical of Macquarie.

Kynikos, founded in 1985, specializes in short-selling the stock of companies the firm believes are overvalued by the financial markets and likely to fall in price. Chanos distinguished himself as one of the most active critics of Enron prior to the company's fall.

In a May 30 radio interview with Australian talk-show host Mark Colvin, Chanos charged that the "Macquarie model" was seriously flawed.

"The bank scours the world buying assets," Chanos told the radio audience, "buying assets, everything from toll roads to bowling alleys and selling them into separate trusts that the bank controls. This generates triple fees for Macquarie Bank: one for the up-front purchase; a second for selling the assets into the trust; then ongoing management and performance fees from the funds."

Chanos charged that the loser in the scheme was the investor.

"If you look at the financial accounts of the trusts," Chanos explained to the Australian talk show, "you'll see that in almost all the cases the companies are using Australian re-valuation accounting which is legal under [Generally Accepted Accounting Practices] in your country to write up the value of the asset annually and put that through operating income and into equity."

Chanos argued that the practice only works in a financial environment in which cheap credit is readily available and valuations for infrastructure projects are generally rising.

"You need a credit environment that looks the other way, or you need a credit environment where the people lending are just lending on reputation or not numbers," Chanos said.

Eventually, he contended, the self-dealing between Macquarie and the Macquarie-controlled funds into which the infrastructure assets are sold is likely to crash.

"All I would tell your listeners," Chanos said in the radio interview, "is simply just go to the trusts, the financial statements, and simply extract out the asset re-valuation number, which is basically management's guess as to how much, what the asset's worth and just see what the cash flow looks like. In many cases, the cash flows are diminished or actually go negative. That's the simple litmus test to the Macquarie model."

Still, Chanos argued that despite the problem in the underlying cash flows, Macquarie makes hefty profits.

"Capital gains alone in the fiscal year 2007, just for flipping these types of assets into the trusts, accounted for half of the pre-tax income of Macquarie Bank," Chanos asserted.

Macquarie Bank has hit back strongly against both critics.

According to newspaper reports in Australia, Macquarie Bank executive Warwick Smith complained to University of Sidney Vice Chancellor Gavin Brown, demanding that the university dissociate itself from Goldberg over his critical research.

In response, Brown issued a statement clarifying that Goldberg is not an employee of the University of Sydney, though he has been given the title of honorary associate by the Faculty of Architecture. In his statement, Brown claimed Goldberg "speaks as an individual and the university accepts no responsibility for his comments which it does not endorse."

In the subsequent controversy that erupted in Australia, Goldberg was featured as a case study in "Silencing Dissent," a book critical of the administration of Prime Minister John Howard, published in Australia by Clive Hamilton, the executive director of a prominent Australian think-tank, and his co-editor Sarah Maddison.

In the book, Hamilton and Maddison charged that the Howard government used strong-arm tactics to challenge the tax status of non-government organizations and ruin the reputations of academics who were critical of governmental policies, including the sale of highway infrastructure leasing rights to private investment concerns in Australia.

Macquarie used a similar personal attack to discredit Chanos following the interview on Australian radio.

In a May 31 statement posted on the Macquarie website, the investment group charged that Chanos, "a hedge fund short-seller of equities," had an economic self-interest in advancing "incorrect claims" that could cause the stock price of Macquarie to fall.

When contacted for comment, Macquarie's New York representative referred WND to the company's online statement, in which Macquarie asserts that all assets acquired by funds controlled by Macquarie are valued directly from the market and subject to the approval of independent directors of the funds.

The published Macquarie response to Chanos also cited a May 25 Bloomberg report which quoted Chanos as saying Kynikos maintains a short position on Macquarie.

Short-selling is a Wall Street practice in which an investor borrows and sells stock the investor does not own, anticipating the stock will go down in value. The short-seller profits by buying shares at a lower price to replace the shares that originally were borrowed and sold at the higher price.

Short-sellers lose money if the price of the stock increases and the cost to purchase shares to replace those borrowed is greater than the price for which the borrowed shares were sold.

Macquarie Infrastructure Group is a separate subsidiary from Macquarie Bank.

The website of Macquarie Infrastructure Group bills the company as "one of the largest private developers of toll roads in the world."

Read more in World Net Daily

Monday, July 16, 2007

Farmers upset over Perry veto of eminent domain bill

LUBBOCK - One Central Texas farmer said he was "dumbfounded" by Gov. Rick Perry's veto of an eminent domain bill designed to protect landowners when the state wants to take their property.

Robert Fleming is not alone in an area worried about the massive Trans Texas Corridor proposal. The planned route cuts through Fleming's Bell County farms. He's bewildered by Perry's veto.

"We were so close to getting something done," Fleming said. "We've worked hard trying to get private property rights."

Perry vetoed the bill, and 48 others, June 15.

In 2005, the U.S. Supreme Court ruled in Kelo et al v. City of New London that cities can seize homes under eminent domain for use by private developers. Texas Farm Bureau spokesman Gene Hall said the ruling also said that states that want it otherwise can craft laws to do so. That's what the bill Perry vetoed would have done, he said.

Perry in 2005 named the eminent domain issue as an emergency item in a special session, Perry spokesman Robert Black said.

"The bill Governor Perry vetoed would have had little impact on rural Texas. It was targeted at high-growth urban areas," Black said.

The Trans Texas Corridor is the plan kick-started several years ago by Perry to build 4,000-plus miles of tollways and railways that would incorporate oil and gas pipelines, utility and water lines and broadband data lines.

One reason Perry gave for vetoing the bill was that it would have expanded damages a landowner could recover to include diminished access to roads from remaining property when a portion of the property is condemned, according to a release from Perry's office.

Also, landowners would have been able to collect damages for factors that include changes in traffic patterns and a property's visibility from the road, which Texas courts have knocked down because of the added costs to public projects that taxpayers would have to pay, the release states.

After the bill passed both houses - 125 of 150 votes in the House and unanimously in the Senate - Perry's office heard from most fast-growing cities and counties asking him to veto the bill; the cost of constructing state and local projects would have increased by more than $1 billion, the release stated.

"As someone who grew up in rural Texas, and farmed our family's piece of land, I am a strong proponent of protecting private property rights," Perry said in the statement. "But the issue is one of fairness to taxpayers, who will get fleeced in order to benefit condemnation attorneys."

Perry supported the bill early on but had objections to amendments added later, the release states.

The eminent domain issue for portions of the corridor proposal currently is on a back burner, Texas Farm Bureau officials said.

"The more time we have to spread our story and to make an issue out of [eminent domain] is certainly going to help the property owners," said Fleming, who grows corn and wheat and raises cattle.

Bureau officials said they believed Perry wanted to fix Texas' eminent domain law, having met with him early in the session.

"The taking of private property has become far too easy in this state," Kenneth Dierschke, president of the bureau, said in a statement. "Obviously, there are many powerful interests that prefer it stay that way."

Fleming took aim at Perry, saying he has turned his back on agriculture and his veto makes that clear.

"I feel like he's let us down a little bit," Fleming said. "He's got big ag background but since he's become a politician, he's kind of left ag out."

Bureau spokesman Gene Hall said the group will work to revisit the issue when legislators next gather in regular session in 2009. And they will talk with Perry.

"All we can do now is talk with him and work with him," Hall said. "We are serious about this."

Read more in Land and Livestock

Tuesday, May 22, 2007

T.U.R.F. warns that Market Valuation in SB 792 allows backdoor CDAs

MARKET VALUATION(IE - CONCESSION FEES) WILL BE MANDATORY ON ALL TOLL PROJECTS IF SB 792 PASSES AS WRITTEN! TRADITIONAL TURNPIKES NO LONGER AN OPTION!

A third party appraiser would determine the market value of the road and that amount, once agreed upon by TxDOT and the tolling entity, would be deposited in subaccounts JUST LIKE A CONCESSION FEE with CDAs! Motorists taking that tollway will then be charged OPPRESSIVELY HIGH TOLLS beyond the cost of building that specific road since the toll rate now has to cover the upfront fee (which is just like a concession fee!).

“Market valuation” is TxDOT and the Governor’s GOTCHA in SB 792. In speaking with many legislators, most DO NOT KNOW THIS and thought market valuation only applied to the buy back provisions or were optional or applied only to certain projects. Senator Robert Nichols added an amendment stating if both the tolling entity and TxDOT CANNOT AGREE on the market value the project cannot move forward. However, most legislators don’t realize this means the PROJECT DIES and cannot go forward USING THE TRADITIONAL TURNPIKE model. So unless your tolling entity can agree with this rogue agency, YOUR PROJECT DIES ALTOGETHER!

Market valuation tolling is like a back door CDA! Do we really have a CDA moratorium when this is the case? Will your constituents back home think YOU VOTED FOR A WIN when they’re going to be charged OPPRESSIVELY HIGH tolls anyway?

We fear this opens another can of worms that will bring regrets similar to HB 3588. Many wanted to “correct the sins of the past” this session in regards to tolling and for having “created a monster” in TxDOT.

Here's what Senator Robert Nichols said about market valuation in the Lone Star Report, May 21, 2007: "For the first time you're having a county toll authority or a regional mobility authority that is going to have to come up with a front end concession, kind of like a private entity. They're going to have to commit to spend those funds. Either to TxDOT or to other projects in that area."

Is getting a compromise bill signed more important than enacting good transportation policy that’s been fully vetted and had the proper public debate? Unleashing yet another monster on the taxpaying public with provisions stuck in a bill at the last minute should cause us all to pause. It’s clear few knew what they were voting on last week. This Legislature needs to step back and focus on getting a good bill passed, not on special session threats or rushing to the finish line empty-handed. May it be said you finished well, and in a way that you won’t regret back home.

Signed,

Terri Hall

Founder/Director

Texans Uniting for Reform & Freedom (TURF) &

San Antonio Toll Party

www.TexasTURF.org

Friday, May 18, 2007

SB 792 passes Senate exempting more tollways from moratorium

More projects exempted from private toll road moratorium in unanimous Senate vote.By Ben Wear - AMERICAN-STATESMAN STAFF - Tuesday, May 15, 2007

The Texas Senate, after hours of closed-door negotiations stamped out hot spots of dissent, unanimously passed revamped toll road legislation Monday that would supplant a bill languishing on Gov. Rick Perry's desk.Read more

Perry, who has made it clear he would veto the first bill, House Bill 1892, immediately signaled that he would allow Senate Bill 792 to become law if the House passes it in its current form. Lawmakers involved in the negotiations say they hope to get SB 792 to Perry late this week in time to avert a veto, although the often-fractious House might not play along.

...

That ban in HB 1892 already had several exemptions for proposed tollways in Dallas-Fort Worth, San Antonio and El Paso. The Senate on Monday, with SB 792, added the Grand Parkway loop planned for Houston, the potential Interstate 69 from near Corpus Christi to Brownsville, and all of Cameron County

Thursday, May 10, 2007

Cintra proposes to use $2.6 Billion in U.S. Federal Money on the $2.8 Billion SH121 Project

Problem: Spanish company to take taxpayers for 50 year toll ride

Solution: Index gas tax

Wonder why all the fuss over toll roads? Well, we’re not talking about traditional toll projects. Governor Perry and his Transportation Commission are pushing private toll road deals that limit free routes and allow the private operator to charge very high tolls. Take a gander at what the winning bidder, a Spanish company named Cintra, is telling their shareholders about the Hwy 121 private toll deal in Collin and Denton counties:

“Provides a corridor to Dallas on which there is no alternative roads.”

– Page 6, It will connect I-35 with US-75

“No planned proposed improvements to free alternative routes in the long term. Concessionaire is entitled for compensation in case existing long-term planning is modified.” – Page 11

You see, as ex-Transportation Commissioner Senator Robert Nichols, who is a stickler for details and who is also the author of a bill to halt CDAs, has noted the devil is in the details. These private toll contracts called Comprehensive Development Agreements (CDAs) include non-compete agreements like Cintra brags about to its shareholders. This means there will be no improvements made to existing roads nor any new free routes built within a certain mile radius of the toll road. Doing so would compete with or reduce toll revenues, and a private company simply won’t allow that.

Toll rates $1.50 a mile

TxDOT promises toll rates of 12-15 cents a mile, but the reality has been 44 cents up to $1.50 PER MILE on similar projects that just opened in Austin. You see, when TxDOT has admitted it costs 11 cents just to collect the tolls, they can’t possibly cover the operation or maintenance of that road with 12-15 cent tolls much less pay the private toll operator their guaranteed 12% profit. In fact, TxDOT’s mantra is that the private company will charge “market rate,” which essentially means tolls without limit since there will be few if any alternatives. Bottom line: using CDA private toll contracts is THE most expensive option for motorists. Yet the Governor and his cronies claim they’re doing all this without raising your taxes. Who do they think they think they’re fooling?

Dennis Enright, an expert in these public-private partnerships testified on March 1 to the Senate Transportation and Homeland Security Committee that CDAs cost 50% more than traditional public toll roads. He also stated it’s always better to keep these toll projects in the public sector (having a tolling authority or TxDOT do them) rather than to privatize our highways in these monopolistic 50-year contracts.

What’s perhaps even more appalling is that the U.S. Government was involved in facilitating some $2.6 billion of this $2.8 billion project. So who’s really bringing the money to the table? The U.S. taxpayer, not the private company as TxDOT claims. So the taxpaying public will pay billions both on the front end with federally backed bonds and loans and on the back end of this deal through tolls for the next 50 years just to accelerate the construction of a single 10 mile stretch of highway.

This same company won a deal to build SH 130, won the development rights to build the first 600 miles of the Trans Texas Corridor (called TTC 35), and is one of two foreign companies bidding to takeover existing highways SH 281 and Loop 1604 in San Antonio and turn them into tollways. Senator Eliot Shapleigh asked TxDOT in a recent Senate Transportation Committee hearing if giving that much of our state highway system to a single foreign company for the next half-century gave him pause. TxDOT dodged the question.

So what’s the solution?

Pass the CDA moratorium

It’s past time to rein-in TxDOT’s push to privatize and toll our public highways in these very controversial deals that amount to horrific public policy. HB 2772 and SB 1267 have more than two-thirds majority support and would place a 2 year moratorium on CDAs giving the Legislature time to get the details of these contracts right before signing away our public highways for 50 years! Senate and House Transportation Committee Chairmen Senator John Carona and Mike Krusee are tying them up. Let’s get these bills to the floor for a vote in time to override a promised gubernatorial veto.

Index the gas tax

Let’s assume that even though TxDOT’s budget has tripled since 1990 and doubled since Rick Perry took office, and even though TxDOT has $7 billion in bonds available to them, that we are still short of cash for highways. A recent Texas Transportation Institute study showed that indexing the gas tax to inflation is all that’s needed to meet our future transportation needs without tolls. Politicians in the House, in particular, need to have the political will to enact the most affordable, most sensible financing solution. All the options we’re faced with are tax increases of one sort or another since tolls are clearly a tax, an aggressive one in the hands of a private company. The gas tax increase would cost perhaps $50 - 100 more a year versus $2,000-3,000 more a year per motorist in tolls!

However, before adding ONE DIME to TxDOT’s budget, the Legislature must also pass Senator Wentworth’s bill to stop any further hemorrhaging of the gas tax that’s been going to non-transportation sources and frivolous earmarks. The taxpayers won’t tolerate putting more money into a leaky boat. That’s what got us into this mess in the first place. So since an ounce of prevention equals a pound of cure, let’s revisit the gas tax to prevent this shady widespread shift to private tolling and be done with it.

UPDATE: Financial analysts say NTTA proposal flawed - could bankrupt toll authority - Proved flawed and from TXDOT!

NTTA Chairman Paul Wageman told lawmakers that he could top the Cintra deal and keep toll road money in North Texas.

Days later, a mysterious letter began making the rounds in Austin blasting the NTTA proposal. It alleged "there is a serious flaw," and also said the "NTTA proposal begins to make no sense."

The critical letter also found its way onto a toll road news web site, where it was billed as an analysis prepared by investment banker Goldman Sachs. Sachs says that characterization is false..

News 8 has learned the letter originated in a state office building at the Dallas division of the Department of Transportation.

Deputy engineer Robert Brown admits that he was the author

Full Report

Concession Texas

Posted Tuesday, May 8, 2008 18:29

A KPMG/Goldman Sachs analysis of the North Texas Toll Authority (NTTA) and Cintra proposals for a toll concession on SH121 says NTTA have used an unrealistically low discount rate on future revenues - giving only the appearance of a superior bid. They say unless NTTA were able to increase toll rates more than the the Dallas Regional Transportation Council (RTC) limits in force on the TxDOT-selected Cintra proposal, the public toll authority could be bankrupted.Click Here to read the entire article

The terse 2-page paper being circulated in Dallas says the NTTA proposal is seriously flawed with its low 5% discount rate. They say that unlike the Cintra offer, the NTTA proposal makes no allowance for risk.

They also suggest NTTA's proposal underfunds operations and maintenance.

Mother Jones reported in January that

the Amount that Goldman Sachs gave to a PAC established by its lobbying firm, Hillco Partners, to push a 2001 Texas ballot measure allowing privately operated roads: $10,000

The Charles Webster, staff reporter for a Trenton, NJ publication cited

The report in Mother Jones magazine found that Goldman Sachs has set up an infrastructure investment arm, and has been working closely with Australian-owned Macquarie Infrastructure Group (MIG) and the Spanish construction firm Cintra to leverage lease deals for public roads and building projects for public highways.

The article describes efforts by Goldman Sachs officials to convince government officials around the country of the benefits of privatizing public roads. But the article also points out that Goldman Sachs is playing more than one side of the transaction.

On one end, Goldman Sachs is advising government entities how to proceed with the transaction, the investment firm is also working in tandem with its friends at MIG and Cintra.

On the another side, an account has created by Goldman Sachs to funnel investors’ money into an investment fund with the sole purpose of investing in highway infrastructure projects. More than $3 billion has already been accumulated into the account.

Webster wrote:

Ohio, Kansas and other states could also be headed in the same direction.

To-date, Goldman Sachs has been hired by four government entities to advise them on how to proceed with privatizing highways.

In the past five years, Goldman Sachs has helped turn over several highways from state-owned to privately run, including the 99-year lease deal of the 7.8-mile Chicago Skyway in 2005.

Shipp followed up his May 14th story the next day with a report that TxDOT has decided to allow NTTA to bid on the SH121 project.

Federal Highway Department objects to NTTA bid for SH121

What is true? What is a misconception? What is the understatement of the truth and what is the overstatement of the facts?

Click here to read the letter.

Lawmakers race to rework transportation measure

jmoritz@star-telegram.com

Posted on Wed, May. 09, 2007

AUSTIN — Under threat of a special session this summer, a key lawmaker said Wednesday that the Legislature plans to scuttle a sweeping transportation measure considered destined for a veto and send the governor a new bill more to his liking.

“I’m not canceling my vacation plans just yet,” said state Sen. John Carona, R-Dallas, who chairs the Senate’s committee on transportation and homeland security.

Two well-placed sources said earlier in the day that Perry would call lawmakers back to Austin unless they undo an element in House Bill 1892 that could cost Tarrant County and other areas tens of millions of dollars for road construction projections.

That feature would undermine plans by local officials in North Texas to spread those dollars all over the region in an effort to ease ever-growing urban and suburban traffic congestion. At risk would be such planned projects as the North Tarrant Express and the western link of Texas 121.

Full story

Wednesday, April 25, 2007

The Billion Dollar Question

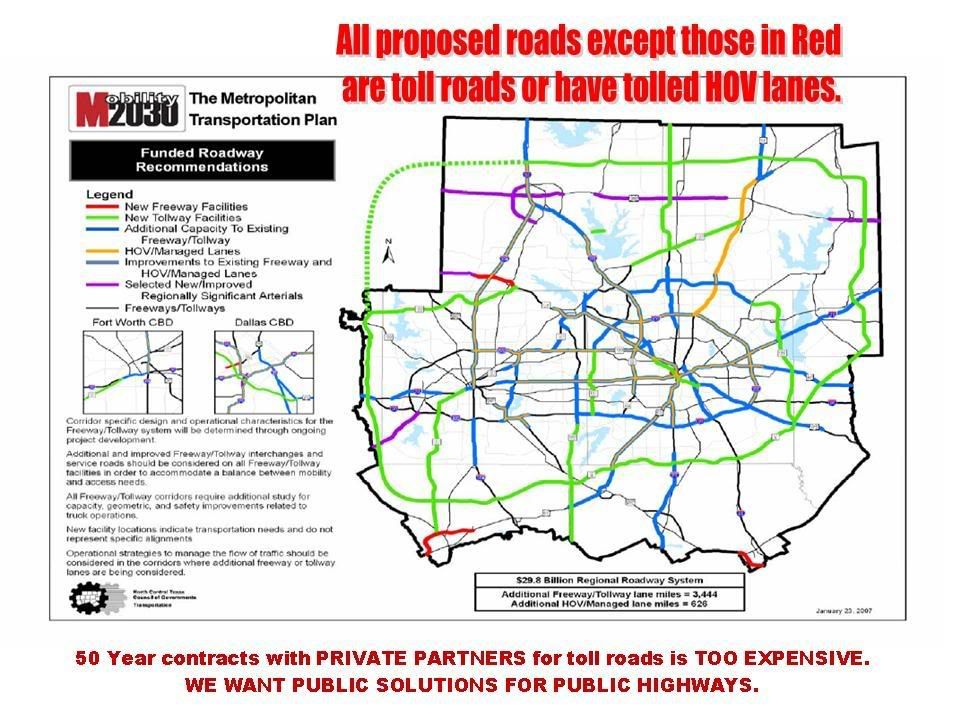

[Click on images to enlarge]

During the 30 years (2000-2030) the RTC (Regional Transportation Commission of the NTCOG) and TxDOT propose to add 675 miles of managed lanes (TOLL FREEWAYS and TOLLED HOV LANES on existing Freeways) in the DFW region.

They only propose adding 70 additional miles of NON-TOLLED FREEWAYS! They are planning to sign 50 year contracts for these tolled managed lanes and toll roads! EXEMPTING DFW from the 2 year moratorium is BAD if this is the BEST THEY HAVE TO OFFER!

The legend is hard to read. It says that:

Green is proposed New Toll ways.

Blue is proposed extensions of existing freeways/toll ways

or improving existing highways/freeways

by adding HOV toll lanes.

Black is freeways/toll ways.

Red is non-tolled freeways.

From 2000 to 2030 the Regional Transportation Plan for DFW:

| 2000 | 25 miles of existing toll roads built and managed by public toll authority |

| 2030 | 675 miles of managed lanes and toll road under CDAs (Public private partnerships with 50 year contracts financed at higher rates than public bond and with higher tolls to generate "SURPLUS TOLL REVENUE" for investor return on investment (profit) and up-front payments to the RTC for use on non-toll projects). |

Will citizens in this area pay more than their fair share for highway construction?

Will they have to pay their fair share of state gasoline and other taxes which builds roads in other regions while still having to pay high tolls to travel in their own region?

Is utilizing state highway right-of-way (real estate) for tolled lanes adjacent to public highway lanes which are insufficient to handle the traffic the best way to address traffic congestion?

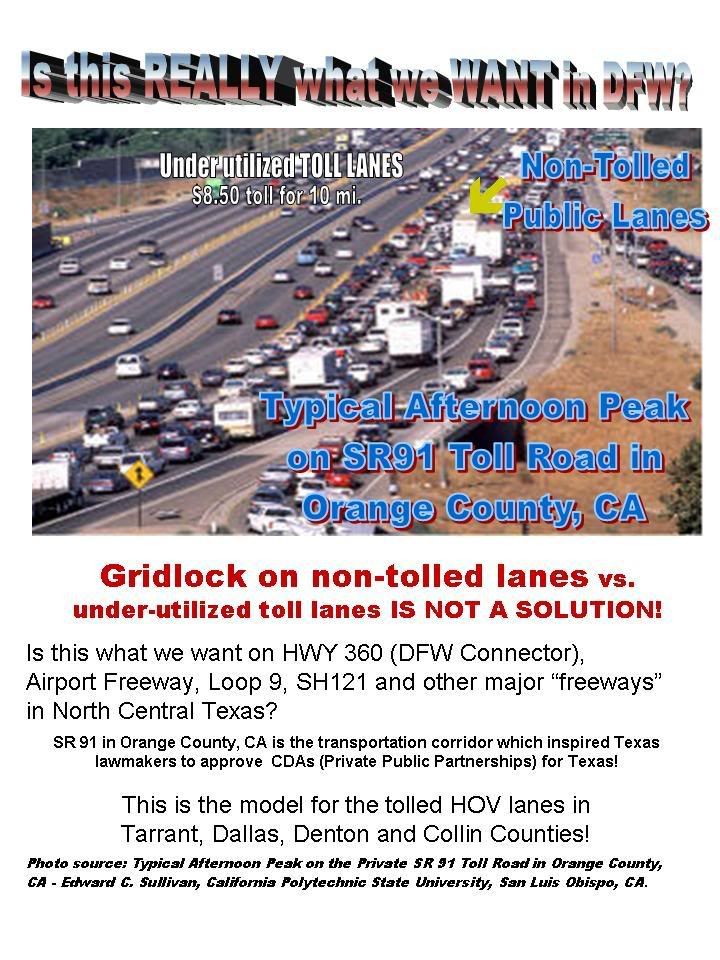

In California, during rush hour traffic, managed HOV toll lanes carry too few cars while public lanes are much too congested. Should we adopt the same model here?

Thursday, April 12, 2007

Texas House Passes Moratorium -- Now it goes to the Senate

WHAT HAPPENS NOW: The bill (text below) with the amendments will go to the Senate. Hopefully, it will pass the Senate. The biggest hurdle will probably be getting Rick Perry to sign it instead of allowing it to lanquish on his desk until after the session is over.

It would be wise for citizens to keep the heat up on the Senate and Rick Perry. Perry should be persuaded to call a special session to consider all the bills he allows to remain on his desk unsigned at the end of the session and/or which he vetoes.

We need to remind people of the fate of Kent Grusendorf when the Legislature failed to adequately address critical school funding issues. This year the focus is on Transportation.

Here is the text of the "engrossed" bill after the amendments were incorporated into the text of the bill.

Engrossed moratorium toll 1892 passed house 4/11/07

By: Smith of Harris, Dutton, Hartnett, H.B. No. 1892

Creighton, Howard of Fort Bend, et al.

A BILL TO BE ENTITLED

AN ACT

relating to the authority of certain counties and other entities with respect to certain transportation projects.

BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF TEXAS:

SECTION 1. Subchapter E, Chapter 223, Transportation Code, is amended by adding Section 223.210 to read as follows:

Sec. 223.210. MORATORIUM ON CERTAIN TERMS IN COMPREHENSIVE DEVELOPMENT AGREEMENTS OR SALE OF TOLL PROJECTS. (a) In this section:

(1) "Toll project" means a toll project described by Section 201.001(b), regardless of whether the toll project:

(A) is a part of the state highway system; or

(B) is subject to the jurisdiction of the department.

(2) "Toll project entity" means a public entity authorized by law to acquire, design, construct, finance, operate, or maintain a toll project, including:

(A) the department;

(B) a regional tollway authority;

(C) a regional mobility authority; or

(D) a county.

(b) A comprehensive development agreement entered into with a private participant by a toll project entity on or after the effective date of this subsection for the acquisition, design, construction, financing, operation, or maintenance of a toll project may not contain a provision permitting the private participant to operate the toll project or collect revenue from the toll project, regardless of whether the private participant operates the toll project or collects the revenue itself or engages a subcontractor or other entity to operate the toll project or collect the revenue.

(c) On or after the effective date of this subsection, a toll project entity may not sell or enter into a contract to sell a toll project of the entity to a private entity.

(c-1) Subsections (b) and (c) do not apply to any project within the boundaries of a regional tollway authority created on September 1, 1997.

(c-2) To the extent that Subsection (c-1) conflicts with Section 228.012, Section 228.012 shall govern.

(c-3) This section does not apply to a comprehensive development agreement for a managed lane facility toll project the major portion of which is located inside the boundaries of a regional tollway authority created on September 1, 1997, and for which the department has issued a request for qualifications before the effective date of this subsection. Before the department executes a final contract for a project described by this subsection, the commissioners court for any county in which a majority of the project is located must pass a supporting resolution that:

(1) acknowledges that the contract may contain penalties for the construction of future competing transportation projects built at any time during the life of the agreement; and

(2) states that the commissioners court is aware of and agrees to pay the penalties if any are rendered.

(d) A legislative study committee is created. The committee is composed of nine members, appointed as follows:

(1) three members appointed by the lieutenant governor;

(2) three members appointed by the speaker of the house of representatives; and

(3) three members appointed by the governor.

(e) The legislative study committee shall select a presiding officer from among its members and conduct public hearings and study the public policy implications of including in a comprehensive development agreement entered into by a toll project entity with a private participant in connection with a toll project a provision that permits the private participant to operate and collect revenue from the toll project. In addition, the committee shall examine the public policy implications of selling an existing and operating toll project to a private entity.

(f) Not later than December 1, 2008, the legislative study committee shall:

(1) prepare a written report summarizing:

(A) any hearings conducted by the committee;

(B) any legislation proposed by the committee;

(C) the committee's recommendations for safeguards and protections of the public's interest when a contract for the sale of a toll project to a private entity is entered into; and

(D) any other findings or recommendations of the committee; and

(2) deliver a copy of the report to the governor, the lieutenant governor, and the speaker of the house of representatives.

(g) On December 31, 2008, the legislative study committee created under this section is abolished.

(h) This section expires September 1, 2009.

SECTION 2. Section 228.0055, Transportation Code, is amended to read as follows:

Sec. 228.0055. USE OF CONTRACT PAYMENTS. (a) Payments received by the commission or the department under a comprehensive development agreement shall [may] be used by the commission or the department to finance the construction, maintenance, or operation of a transportation project or air quality project in the same department district as the project or facilities to which the payments are attributable or a department district adjacent to that district [region].

(b) The commission or the department may not:

(1) revise the formula as provided in the department's unified transportation program, or its successor document, in a manner that results in a decrease of a department district's allocation because of a payment under Subsection (a); or

(2) take any other action that would reduce funding allocated to a department district because of payments received under a comprehensive development agreement.

SECTION 3. Subchapter A, Chapter 228, Transportation Code, is amended by adding Section 228.011 to read as follows:

Sec. 228.011. TOLL PROJECTS IN CERTAIN COUNTIES. (a) This section applies only to a county acting under Chapter 284.

(b) The county is the entity that has primary responsibility for the financing, construction, and operation of a toll project located in the county.

(c) To the extent authorized by federal law or authorized or required by this title, the commission and the department shall assist the county in the financing, construction, and operation of a toll project in the county by allowing the county to use highway right-of-way owned by the department and to access the state highway system. In connection with the use by the county of improved state highway right-of-way, the county must enter into an agreement with the commission or the department as provided by Section 284.004(b).

(d) Subsections (b) and (c) do not limit the authority of the commission or the department to participate in the cost of acquiring, constructing, maintaining, or operating a turnpike project of the county under Chapter 284.

(e) Before the commission or the department may enter into a contract for the financing, construction, or operation of a proposed or existing toll project any part of which is located in the county, the commission or department shall provide the county the first option to finance, construct, or operate, as applicable, the portion of the toll project located in the county:

(1) on terms agreeable to the county, without the requirement of any payment to the commission or the department except as provided by Section 284.004(a); and

(2) in a manner determined by the county to be consistent with the practices and procedures by which the county finances, constructs, or operates a project.

(f) Except as provided by Section 284.004(a), an agreement entered into by the county and the commission or the department in connection with a project under Chapter 284 that is financed, constructed, or operated by the county and that is on or directly connected to the state highway system may not require the county to make any payments to the commission or the department.

(g) An agreement entered into by the county and the commission or department in connection with a project under Chapter 284 that is financed, constructed, or operated by the county and that is on or directly connected to a highway in the state highway system does not create a joint enterprise for liability purposes.

SECTION 4. Subchapter A, Chapter 228, Transportation Code, is amended by adding Section 228.012 to read as follows:

Sec. 228.012. TOLL PROJECTS WITHIN BOUNDARIES OF REGIONAL TOLLWAY AUTHORITY. (a) This section applies only to a toll project located within the boundaries of a regional tollway authority under Chapter 366.

(b) The tollway authority is the entity that has primary responsibility for the financing, construction, and operation of a toll project located within the boundaries of the authority.

(c) To the extent authorized by federal law or authorized or required by this title, the commission and the department shall assist the tollway authority in the financing, construction, and operation of a toll project located within the boundaries of the authority by allowing the authority to use highway right-of-way owned by the department and to access the state highway system.

(d) Subsections (b) and (c) do not limit the authority of the commission or the department to participate in the cost of acquiring, constructing, maintaining, or operating a turnpike project of the tollway authority under Chapter 366.

(e) Before the commission or the department may enter into a contract for the financing, construction, or operation of a proposed or existing toll project any part of which is located within the boundaries of a tollway authority, the commission or department shall provide the authority the first option to finance, construct, or operate, as applicable, the portion of the toll project located within the boundaries of the authority:

(1) on terms agreeable to the authority, without the requirement of any payment to the commission or the department; and

(2) in a manner determined by the authority to be consistent with the practices and procedures by which the authority finances, constructs, or operates a project.

(f) An agreement entered into by the tollway authority and the commission or the department in connection with a project under Chapter 366 that is financed, constructed, or operated by the authority and that is on or directly connected to the state highway system may not require the authority to make any payments to the commission or the department.

(g) An agreement entered into by the tollway authority and the commission or department in connection with a project under Chapter 366 that is financed, constructed, or operated by the authority and that is on or directly connected to a highway in the state highway system does not create a joint enterprise for liability purposes.

(h) Before a final contract execution by the department for any comprehensive development agreement project, the commissioners court for any county in which a majority of the project is located must pass a supporting resolution.

(i) Once the authority or regional transportation council has received notice from the department relating to a toll project, the authority has 90 days to exercise the first option to finance, construct, or operate, as applicable, the toll project.

SECTION 5. Section 284.001(3), Transportation Code, is amended to read as follows:

(3) "Project" means:

(A) a causeway, bridge, tunnel, turnpike, highway, ferry, or any combination of those facilities, including:

(i) [(A)] a necessary overpass, underpass, interchange, entrance plaza, toll house, service station, approach, fixture, and accessory and necessary equipment that has been designated as part of the project by order of a county;

(ii) [(B)] necessary administration, storage, and other buildings that have been designated as part of the project by order of a county; and

(iii) [(C)] all property rights, easements, and related interests acquired; or

(B) a turnpike project or system as those terms are defined by Section 370.003.

SECTION 6. Section 284.002, Transportation Code, is amended to read as follows:

Sec. 284.002. APPLICABILITY OF CHAPTER [TO CERTAIN COUNTIES AND LOCAL GOVERNMENT CORPORATIONS]. (a) Except as provided by Subsection (b), this chapter applies only to a county that[:

[(1)] has a population of 10,000 [50,000] or more [and borders the Gulf of Mexico or a bay or inlet opening into the gulf;

[(2) has a population of 1.5 million or more;

[(3) is adjacent to a county that has a population of 1.5 million or more; or

[(4) borders the United Mexican States].

(b) A local government corporation created under Chapter 431 in a county to which this chapter applies has the same powers as a county acting under this chapter, except as provided by Chapter 362.

SECTION 7. Section 284.003, Transportation Code, is amended to read as follows:

Sec. 284.003. PROJECT AUTHORIZED; CONSTRUCTION, OPERATION, AND COST. (a) A county, acting through the commissioners court of the county, or a local government corporation, without state approval, supervision, or regulation, may:

(1) construct, acquire, improve, operate, maintain, or pool a project located:

(A) exclusively in the county;

(B) in the county and outside the county; or

(C) in one or more counties adjacent to the county;

(2) issue tax bonds, revenue bonds, or combination tax and revenue bonds to pay the cost of the construction, acquisition, or improvement of a project;

(3) impose tolls or charges as otherwise authorized by this chapter;

(4) construct a bridge over a deepwater [deep water] navigation channel, if the bridge does not hinder maritime transportation; [or]

(5) construct, acquire, or operate a ferry across a deepwater navigation channel;

(6) in connection with a project, on adoption of an order exercise the powers of a regional mobility authority operating under Chapter 370; or

(7) enter into a comprehensive development agreement with a private entity to design, develop, finance, construct, maintain, repair, operate, extend, or expand a proposed or existing project in the county to the extent and in the manner applicable to the department under Chapter 223 or to a regional tollway authority under Chapter 366.

(b) The county or a local government corporation may exercise a power provided by Subsection (a)(6) only in a manner consistent with the other powers provided by this chapter. To the extent of a conflict between this chapter and Chapter 370, this chapter prevails.

(c) A project or any portion of a project that is owned by the county and licensed or leased to a private entity or operated by a private entity under this chapter to provide transportation services to the general public is public property used for a public purpose and exempt from taxation by this state or a political subdivision of this state.

(d) If the county constructs, acquires, improves, operates, maintains, or pools a project under this chapter, before December 31 of each even-numbered year the county shall submit to the department a plan for the project that includes the time schedule for the project and describes the use of project funds. The plan may provide for and permit the use of project funds and other money, including state or federal funds, available to the county for roads, streets, highways, and other related facilities in the county that are not part of a project under this chapter. A plan is not subject to approval, supervision, or regulation by the commission or the department.

(e) Except as provided by federal law, an action of a county taken under this chapter is not subject to approval, supervision, or regulation by a metropolitan planning organization.

(f) The county may enter into a protocol or other agreement with the commission or the department to implement this section through the cooperation of the parties to the agreement.

SECTION 8. Subchapter A, Chapter 284, Transportation Code, is amended by adding Sections 284.0031 and 284.0032 and amending Section 284.004 to read as follows:

Sec. 284.0031. OTHER ROAD, STREET, OR HIGHWAY PROJECTS. (a) The commissioners court of a county or a local government corporation, without state approval, supervision, or regulation may:

(1) authorize the use of surplus revenue of a project for the study, design, construction, maintenance, repair, or operation of roads, streets, highways, or other related facilities that are not part of a project under this chapter; and

(2) prescribe terms for the use of the surplus revenue, including the manner in which the roads, streets, highways, or other related facilities are to be studied, designed, constructed, maintained, repaired, or operated.

(b) To implement this section, a county may enter into an agreement with the commission, the department, a local governmental entity, or another political subdivision of this state.

(c) A county may not take an action under this section that violates or impairs a bond resolution, trust agreement, or indenture that governs the use of the revenue of a project.

(d) Except as provided by this section, a county has the same powers and may use the same procedures with respect to the study, financing, design, construction, maintenance, repair, or operation of a road, street, highway, or other related facility under this section as are available to the county with respect to a project under this chapter.

(e) Notwithstanding any other law, an authority created pursuant to Chapter 451 that is located primarily in a county with a population of more than 3.3 million to which this chapter applies and in which the voters have authorized the dedication of a portion of its sales and use tax revenue for street improvements and mobility projects within the authority's service area must account for the entire amount of that liability on its financial statements in accordance with generally accepted accounting principles.

Sec. 284.0032. TRANS-TEXAS CORRIDOR PROJECTS. If a county requests or is requested by the commission to participate in the development of a project under this chapter that has been designated as part of the Trans-Texas Corridor, in connection with the project and in addition to the other powers granted by this chapter, the county has all the powers of the department related to the development of a project that has been designated as part of the Trans-Texas Corridor.

Sec. 284.004. USE OF COUNTY PROPERTY AND STATE HIGHWAY ALIGNMENT, RIGHT-OF-WAY, AND ACCESS. (a) Notwithstanding any other law, under this chapter a county may use any county property, state highway right-of-way, or access to the state highway system [for a project under this chapter], regardless of when or how the property, right-of-way, or access is acquired. The department or the commission may require the county to comply with any covenant, condition, restriction, or limitation that affects state highway right-of-way, but may not:

(1) adopt rules or establish policies that have the effect of denying the county the use of the right-of-way or access that the county has determined to be necessary or convenient for the construction, acquisition, improvement, operation, maintenance, or pooling of a project under this chapter or the implementation of a plan under Section 284.003(d); or

(2) require the county to pay for the use of the right-of-way or access, except to reimburse the commission or department for actual costs incurred or to be incurred by a third party, including the federal government, as a result of that use by the county.

(b) If a project of the county under this chapter includes the proposed use of improved state highway right-of-way, the county and the commission or the department must enter into an agreement that includes reasonable terms to accommodate that use of the right-of-way by the county and to protect the interests of the commission and the department in the use of the right-of-way for operations of the department.

(c) Notwithstanding any other law, the commission and the department are not liable for any damages that result from a county's use of state highway right-of-way or access to the state highway system under this chapter, regardless of the legal theory, statute, or cause of action under which liability is asserted.

SECTION 9. Sections 284.008(c) and (d), Transportation Code, are amended to read as follows:

(c) Except as provided by Subsection (d), a project becomes a part of the state highway system and the commission shall maintain the project without tolls when:

(1) all of the bonds and interest on the bonds that are payable from or secured by revenues of the project have been paid by the issuer of the bonds or another person with the consent or approval of the issuer; or

(2) a sufficient amount for the payment of all bonds and the interest on the bonds to maturity has been set aside by the issuer of the bonds or another person with the consent or approval of the issuer in a trust fund held for the benefit of the bondholders.

(d) A [Before construction on a project under this chapter begins, a] county may request that the commission adopt an order stating that a [the] project will not become part of the state highway system under Subsection (c). If the commission adopts the order:

(1) Section 362.051 does not apply to the project;

(2) the project must be maintained by the county; and

(3) the project will not become part of the state highway system unless the county transfers the project under Section 284.011.

SECTION 10. Subchapter A, Chapter 284, Transportation Code, is amended by adding Section 284.0092 to read as follows:

Sec. 284.0092. AUDIT BY FEDERAL HIGHWAY ADMINISTRATION. The accounts and records of a county relating to a project under this chapter located in a county that has a population of more than 3.4 million and is within 100 miles of the Gulf of Mexico are subject to audit by the Federal Highway Administration as deemed necessary by that agency.

SECTION 11. Subchapter A, Chapter 284, Transportation Code, is amended by adding Section 284.010 to read as follows:

Sec. 284.010. CONTRACTOR CONTRIBUTIONS PROHIBITED. A person who enters into a contract with a county under this chapter may not make a political contribution to a person who is a commissioner or county judge of the county or who is a candidate for the office of commissioner or county judge of the county.

SECTION 12. Sections 284.065(b) and (c), Transportation Code, are amended to read as follows:

(b) An existing project may be pooled in whole or in part with a new project or another existing project.

(c) A project may [not] be pooled more than once.

SECTION 13. Subtitle G, Title 6, Transportation Code, is amended by adding Chapter 371 to read as follows:

CHAPTER 371. PROVISIONS APPLICABLE TO MORE THAN

ONE TYPE OF TOLL PROJECT

Sec. 371.001. VEHICLES DISPLAYING "HYBRID VEHICLE" INSIGNIA. (a) In this section, "toll project" means a toll project described by Section 201.001(b), regardless of whether the toll project is:

(1) a part of the state highway system;

(2) subject to the jurisdiction of the department; or

(3) constructed or operated by the department or another entity authorized to construct or operate a toll project.

(b) A motor vehicle displaying the "hybrid vehicle" insignia authorized by Section 502.1861 in an easily readable location on the back of the vehicle may use a high occupancy vehicle lane located on a toll project regardless of the number of occupants in the vehicle unless the use would impair the receipt of federal transit funds.

SECTION 14. Subchapter D, Chapter 502, Transportation Code, is amended by adding Section 502.1861 to read as follows:

Sec. 502.1861. "HYBRID VEHICLE" INSIGNIA FOR CERTAIN MOTOR VEHICLES. (a) At the time of registration or reregistration of the motor vehicle, the department shall issue a specially designed "hybrid vehicle" insignia for a motor vehicle that draws propulsion energy from both gasoline or conventional diesel fuel and from a rechargeable energy storage system.

(b) The department shall issue a "hybrid vehicle" insignia under this section without the payment of any additional fee to a person who:

(1) applies to the department on a form provided by the department; and

(2) submits proof that the motor vehicle being registered is a vehicle described by Subsection (a).

SECTION 15. Section 370.031(c), Transportation Code, is repealed.

SECTION 16. Notwithstanding any other provision of this Act, Section 228.012, Transportation Code, as added by this Act, takes effect immediately if this Act receives a vote of two-thirds of all the members elected to each house, as provided by Section 39, Article III, Texas Constitution. If this Act does not receive the vote necessary for immediate effect, Section 228.012, Transportation Code, takes effect September 1, 2007.

SECTION 17. This Act takes effect immediately if it receives a vote of two-thirds of all the members elected to each house, as provided by Section 39, Article III, Texas Constitution. If this Act does not receive the vote necessary for immediate effect, this Act takes effect September 1, 2007.

source: Texas Legislature House website

Wednesday, March 07, 2007

Toll Scheme Unravels - Part 2 - TTC With NAIS fuels inflation

Supporters of the TTC and NAIS appear to be concentrated in urban center. Regional Councils of Government Transportation Committees (RTCs) are the most ardent supporters of the TTC and other proposed private public partnership toll road construction and /or operation contracts. In attempting to get a short term solution for scarce transportation funding for local and regional projects, many city councils and county governments have signed on to the "Toll them as much as you can for as long as you can" schemes which will cost motorists (and consumers) more to travel and ship goods along most of the states future roads and road expansion projects.

It could appear to be a rural vs. city issue, but it is not. It is really a power grab through TxDot by some local elected politicians to transfer "upfront" money to unelected appointed Regional Transportation Committees. Combined with implementation of the mandatory National Animal Identification System in Texas, it will result in surges of inflation which will threaten the economic welfare of every person and business in Texas.

They sold this scheme with a carrot of "up front money" dangled to local governmental officials through RTCs. No one examined the payload of hidden costs, detrimental financial impact or short term/long term inflation. TxDot and RTCs have downplayed the significant difference in the cost for funding road projects with private for profit companies instead of using public money, indexing the gas tax and applying designated funding to transportation.

This series of journals discusses two issues which are linked. They are linked because they are both schemes which will transfer money and financial opportunities from many for the benefit of a few for terms of at least 50 years. Through proposed exercise of eminent domain, more acreage will move from private ownership to State ownership to be controlled for the financial benefit of private concessionaires (Cintra and Zachry). NAIS hits the farmers and ranchers hardest economically. However its impact reverberates throughout the economy and will fuel inflation which will take "buying power for the same dollar" out of the pockets of every business, man, woman and child in Texas. It will impact every consumer of goods produced and or marketed from Texas -- irregardless of where they live.

Construction of the Trans Texas Corridor and expansion and construction of other new highways using the private public partnership models of the TTC and Texas State Highway 121 will take money out of the pockets of every consumer who purchases goods that originate in Texas or are shipped through Texas.

I'll start out by discussing the cost of tuna fish. Most folks are familiar with buying tuna fish in the grocery store on sale. Last year we could usually find it on sale at 3 cans for a dollar. This year on sale it is more frequently offered as 10 cans for $10. Last year it was 33 cents can – this year it is a dollar a can. That is a 200% increase in one year for a commonly purchased food product. Rich and poor alike buy groceries. They are basic necessities. We could have used hamburger meat instead of tuna fish for this example but I chose tuna. The cost of tuna rose, not because of increase manufacturing cost or a significant shift in supply or demand for tuna. It rose last year because of increased gasoline costs for shipping. Shipping costs are usually passed on 100% to the consumer. Inflated fuel costs results in inflation when we go to the checkout counter in the grocery store.

Implementing the private public toll road partnership for building Texas Highways as toll roads will have a very similar impact on the price of goods when we are standing at the check out counter. When we buy hammers or nails, when we buy feed, when we buy tuna fish, when we buy clothes, when we buy medication, we'll pay higher prices to cover the merchants’ increases in shipping costs for the goods. When we buy meat we’ll pay for the increase in shipping for the feed and supplies to feed the beef plus increases in shipping costs to the slaughter houses and then to the market. If the TTC or another toll road is cut through a ranch or farm, that will be the route to market. They’ll have to pay to use the road that cuts through land they used to own!

Proponents of the private/public transportation partnership argue that those who choose to drive on the roads will be the ones to pay the tolls. However, all of us, no matter where we live and even if we never drive or ride down the toll road, we’ll pay for it. When we check out at the grocery store, part of our grocery bill will cover profit for the private company operating toll roads and for “up front money” for local politicians to control and divide up as “pork”. It will be a very poorly hidden regressive tax which will fuel inflation and force us to make tough personal financial decisions. State and local elected officials have ducked out and avoided facing the tough budgetary issues head-on. These private/public partnerships are appealing to them on the surface but will deliver a financial payload that will be devastating to local citizens, businesses and government alike.

One of the cruelest aspects of the Cintra/SH121 contract (which is the first of many TxDot plans to sign in the near future all over Texas) is that children (including two generations who are not even born yet) will be paying the highest tolls and related shipping fees for goods and services under the escalating toll private public partnership agreements.

There will be some increase to pay for road maintenance and construction no matter what policies are implemented. However, the private/public partnership toll road schemes devised to generate as much "excess toll revenue" so that private partners can make profit while distributing substantial sums as "up front money" to regional transportation committees will help accelerate the rise in inflation. It is probable, that coupled with implementation of NAIS and continuing high energy costs, we'll return to the nightmare days of double-digit inflation. It is quite possible that we'll be seeing escalating inflation while salaries and real income stays flat or drops off. To control inflation we usually see interest rates on loans, and home mortgages rise. Folk make only the same or less money but have to spend more for a can of tuna, for clothes, people have to pay higher house payments for the same house when inflation rises. Folks pay more to finance automobiles. These are issues which are of paramount importance to every city dweller and every business person.

The farmers and ranchers are leading the charge in Texas in opposition to NAIS and TTC. We all must join in.

There are many cost in implementation of NAIS. We'll discuss them further in the comments section and in journals later this week. Please pass links to this journal along to your friends and ask them to join in the conversation. The more that recommend and comment on this series, the more visibility we can give this issue.

Crossposted on Texas Koas, Daily Kos and Diatribune.

Photos used by permission, courtesy of Sal Costello, Judith McGeary, Pam Thompson, Tatum Evans and Tom Blackwell.

Friday, January 19, 2007

TCC big money interests spread propoganda

It is a big shell game and they persist in playing Texas voters (Democratic, Republican and Independent)as fools. Across Texas billboards have appeared claiming that the TTC will give us jobs and make us safer! These boards appear to be Clear Channel bulletins paid for by the Outdoor Advertising Association. Wonder if they have an under the table agreement with the state that they'll get the contracts for new billboards? Something is up folks and it isn't good.

Texans are uniting against the TTC. Texas Toll Party, Independent Texans are joining with Texas Democrats and Republicans. March 2nd (Texas Independence Day) there will be a rally in Austin by Texans who want their tax money to be spent for the highest priorities --- good roads and highways, no tolls, state control of infrastructure. We'll share more information as we get it.

Tuesday, August 01, 2006

A TRANS TEXAS CORRIDOR NAFTA PARABLE

The Trans Texas Corridor initiative seems more like this parable:

Once upon a time let's say that I discovered that it was closer for me to go through your yard than it was for me to go around the block on the public street to conduct my business in the land beyond your homestead. So I begin to habitually take a short-cut through your yard. I make my own path through your shrubbery, detouring around your house and garage and walk through your property to deliver goods to my clients who live far beyond your lot line.

After a while, I complain about how much time I'm losing having to go between your house and garage. For me, I'd get there easier and faster if your house weren't in my way. I mean, after all, why should I be inconvenienced having to detour around your house when I have important business to conduct on the other side of your property!

Under current law, I can't just legally tear your house down. But I know some folks who owe me some favors. I do some things for some other folks so that they'll also owe me. I approach a man who owns a paving company with strong ties with the agency which regulates planning and construction of public paths. Then I find some "business men" and show them how they can profit if your house were gone and we had a direct path WE CONTROLLED through your property and this man's paving company poured the asphalt. Together we start dreaming about this path. Wouldn't it be even better, someone says, if there are concessions along the path. If they can't get off the path to patronize the businesses along existing streets, that will be better for us because we'll make more money. So while the "you scratch my back I'll scratch yours" gang is busy revising the Transportation and Property Codes of the government, we have them add in a clause allowing exercise of eminent domain for construction of a facility which serves users of the toll facility.

By scratching backs and showing folks how they can PROFIT from my scheme, I've moved from just cutting through your bushes and walking between your house and garage as I cut through to the other side of property to conduct my business on the other side of you to actually getting the law changed so that I can have your home torn down and land confiscated by the state. I can also get your neighbor's land condemned by eminent domain because it's contingent to a toll corridor and is NEEDED TO BE USED FOR A CONCESSION WHICH WILL BE USED BY USERS OF THE TOLL PATH.

Now, there are a lot of places in our town where more people actually need a paved path more than this one. There may even be some places where they need a bridge. But this project gets priority because I agree to pay for the clearing, demolition of your house, and the concrete to pave it. I get a 50 year right to set the rates for the toll and operate all the concessions along the path. I get the government to underwrite a lot of the studies and planning for this project because they are in the business of overseeing planning projects.

After we pour all this concrete the neighborhood looks different. Because it looks DIFFERENT, some people call it progress.

You no longer live there. Your next door neighbor no longer lives in the town. The land now belongs to the state. Your neighbors get their tax bills after completion of this project. The school district and county and city have divided their annual budgets among the number of remaining homeowners. Everyone has a tax increase. There is still a shortfall because even with a tax increase, there is less land available and when they need to build a new school, the price is higher for the land. But that's ok. Because it is now easier for the folks I did business with on the other side of your property to go through the path and not have to detour around where your house used to sit. No one actually stops on your land to do anything. They use the concession where your next door neighbor used to live as they travel through. But they don't patronize any of the businesses on the street where you lived. When they carry packages along this toll road to deliver to your former neighbors, they pay tolls. But that's o.k. because the pass the additional cost along to the buyers.

Oh, I forgot one thing. When I sell the VISION for building this toll path corridor, I point out that we need A MUCH WIDER RIGHT OF WAY than is actually called for right now. We need to plan for 50 years in the future. So we advise the "I'll scratch your back if you scratch mine gang" to write the law so that instead of the land that the path needs being condemned, they condemn three times that much land. We won't use it for 50 years, but that's o.k. We'll control it. It goes out of the local tax base too and more folks lose their homes. Those that remain have to absorb an even larger percentage of the taxes formerly paid by you and your neighbor. But I'm content.

I'm given an award by the City Father's for being a "Catalyst of Progress." I have more money, so I give a little of it to a charity run by one of the folks who helped me get the laws changed to Legalize all the illegal obstacles to progress that I decided needed to be eliminated so that I'd be enabled to "get a return on my investment" as I instigate getting this toll path built so that I'll not to be inconvenienced by having to detour around your house. I'm now known as a "humanitarian."

Our project has utilized public governmental planning agencies who usually plan public projects. They haven't had time to concentrate on public works projects except for our path. So the street that runs in front of the property where you used to live becomes filled with potholes and is actually dangerous to pedestrians and drivers. The tax base is less. The businesses on that road have closed down because they lost business when people started patronizing the businesses on the toll path. We approach the city and tell them that we can solve their problem. We'll use a bit of the money we made operating this first toll path to repair roads which are currently PUBLIC ROADS if they are turned into toll roads and we are given 50 years to operate them so we can get a return on our investment.

This time there are activists who are prepared for us and manage to demand this project be put to a vote. But it is obvious that the road will remain impassable because now the tax base of the town has dwindled to such a state that there REALLY IS no money in the budget to pave the public road. The toll initiative on the ballot passes by only a few votes, but I have a new project to profit on with my friend the paving contractor. The public street is now a toll road and we are studying where we want to locate the concessions.

--------

There will be goods shipped through Texas from Mexico to other states whether or not the TTC is constructed. Some folks are wondering TEXANS should give up our land and finance the TTC by paying tolls and higher property and school taxes! Don't we have other more important transportation needs that need to be met right now? TDoT, elected officials and transportation planners in COGS tell us that the TTC is necessary because we need to plan for 50 years in the future.

Planning for the future is fine when you have your CURRENT HOUSE IN ORDER. People without food on the table can't throw their entire annual budget into a retirement account. This initiative is one that transfers resources away from meeting VITAL TRANSPORTATION NEEDS in communities all over Texas right now! DFW is on the brink of having EPA shut down economic development. We have to address air quality along with transportation. Every urban center in Texas needs SOME transportation solution and this TTC snowgoose doesn't meet ANY OF THEM. But it's true, business interest shipping goods from Asia to Mexican ports will get those goods to market somehow. They want us to cut them a direct, less-costly-for-them route. We must fight for OUR NEEDS TO BE ADDRESSED before their comfort! If we build a corridor or highway or rail line for US, and they use it too, that's normal. That's not what they are asking. THE TTC is not a transportation plan to meet the needs of Texans. Instead of concentrating on this state's highest priority transportation needs, we're expected to forgo what we need to build this rail, utility and super toll highway from Laredo to Oklahoma to facilitate shipping through Texas.

Let's end this "good night" story with a quote from a lady who addressed the TDoT officials at the Dallas TTC Hearing: "What part of stupid do you think we are?"