Political commentary and analysis of current Texas Policies. Focuses on pending legislation with action alerts. Applies a “Follow the Money progressive approach” to local and state officials' roles in public policy.

Wednesday, January 14, 2009

A Warm and Fuzzy Day in Austin

Yesterday was a rare day in Texas History. The opening day of the 81st Texas Legislaturerare day of amiability in the Texas Legislature was exceptionally warm and fuzzy as Democrat after Democrat seconded the nomination of Rep. Joe Strauss of Bexar County for Speaker of the Texas House. Voted Speaker by Acclaimation, Strauss, a two-term representative (R) is heralded as the conciliator, listener, get things done for the people guy for the job. His election was greeted with a standing ovation with everyone in the house on their feet. There were more "hold outs" when the crowd was urged to thank outgoing Speaker Tom Craddick and his wife for their service to the State of Texas!

Today the real work begins. As the House and Senate begin debating what laws need to be repealed and what needs to be passes, much of the warmth will probably fade. The Trans Texas Corridor has merely been rebranded -- not killed. Years of special interest bought and paid for private public partnership toll road legislation needs to be wiped from the books. Statutes which allows TxDOT or contractors on the TTC who contaminate Texas property in planning or constructing the Trans Texas Corridor to 1. perform their own environmental studies 2. condemn contaminated property and adjacent property must be wiped from the books.

Texas needs to repeal Perry's substitute for the Texas Toll Road Moratorium which requires market pricing on Texas toll roads. Hopefully, the Obama administration will repeal George W. Bush's outgoing gift to the American people - requirements of market valuation aka congestion pricing on Federal toll roads and HOV lanes. Congestion pricing does not clean up the air. It merely fleeces the least able to pay of more dollars when they have to commute during rush hour while allowing those with discretionary income or able to pass along the cost to clients, employers or the american public through expense accounts to utilize the fast lane while the rest are left in their exhaust fumes in traffic gridlock. Local townships, cities and counties eat the fruit of so-called congestion pricing as they scramble to maintain and expand local roadways to accommodate the cars which seek other routes home and to work.

Another hot topic this session is education financing. School funding has not been indexed to meet inflation. Cuts in education funding in the prior session is resulting in cuts in programs, staffing.

Sunday, October 07, 2007

Failed Electric Utility Policy in Texas

Utility deregulation was supposed to lower utility rates in Texas. Instead, Texans have seen rates escalate to 200%-300% since deregulation. A hodgepodge of policies on credit eligibility, credentials for eligibility for deposit waivers for the medical infirm or elderly complicates decision making for many citizens. KWw hour rates quoted by some providers do not always include all the fees charged for electric service. Consumers are penalized for falling below minimum usage amounts on many plans. Customers with poor credit are refused service by companies with the lowest rates.

Even when some Texans "shop around" and find up to "25% savings on rates", they report paying double and triple the amount they paid prior to deregulation. Yes, higher natural gas rates fuel some of the rate hikes. While utility rates have escalated, profits by utility companies have also escalated. Yet when some utility representatives discuss the floating price caps utilized as deregulation was phased in here in Texas, they speak of "losing money". Even though they have had increases in profit and revenue, they speak of the difference between what might have occurred if there had been no floating price caps to help ease in deregulation and the increased profits they made with the price caps as if they were a "loss of income" instead of referring to it more correctly as a difference in the level of increased profit/earnings!

In a news story in today's Houston Chronicle reporters Tom Fowler and Janet Elliott conclude that utility deregulation in Texas is a "failed waste of time" which "fails to slash electric bills."

When Texas lawmakers agreed to open the state's power markets to competition back in 1999, one promise was on the tip of many tongues: lower prices.

"Competition in the electric industry will benefit Texans by reducing monthly rates and offering consumers more choices about the power theyuse," then-Gov. George W. Bush said at the time.

Then-state Sen. David Sibley, who was a key author of the bill, put the promise more bluntly:

"If all consumers don't benefit from this, we will have wasted our time and failed our constituency," he said.

Eight years later, many consumers are calling deregulation just that — a failed waste of time.

"IT'S LIKE THERE IS A PENALTY FOR BEING A TEXAN WHEN IT COMES TO YOUR LIGHT BILL." Mike Coleman

From 2000 to June of this year, the average electric rate in Texas rose 56 percent, more than in all but three states, according to the most recent federal figures.

...

MUNICIPAL OWNED UTILITIES EXEMPT FROM DEREGULATION CHARGE LOWER RATES THAN DEREGULATED UTILITIES IN TEXAS

Tom Fowler and Janet Elliott illustrate this point with CPS Energy, a city-owned utility whih serves San Antonio. City owned utilities are exempt from deregulation. "

San Antonians must buy their power from just one source: CPS.

Yet being exempt from deregulation has benefited CPS customers, who are paying less for electricity than residential customers in other big Texas cities.

The 25 percent of Texans living in regulated markets generally pay less than consumers in markets such as Houston that have been opened to competition.

For example, Houston residential consumers use an average of 1,130 kilowatt hours a month. Bills for that much power would range from $125.43 to $163.85 based on rates available in Houston at the end of September for a one-year, fixed-rate plan. The average rate in Houston would produce a monthly bill of $142.95.

The same amount of electricity would cost $94.40 from CPS in San Antonio and $105.32 in Austin, also served by a city-owned utility.--Elliott and Fowler

TEXAS HOMEOWNERS LESS SHIELDED FROM FLUCTUATIONS IN NATURAL GAS PRICES THAN RESIDENTS IN OTHER STATES:

But the very structure of Texas' deregulated market exposes customers to the full impact of rising natural gas prices more than in other states, or even in parts of Texas still served by regulated electric companies, municipally owned utilities or electric cooperatives.

Steve Bartley, CPS vice president of government and regulatory relations, told Flowler and Elliott that

CPS historically has had lower rates than investor-owned

utilities in Texas primarily because of the fuel mix it uses to generate electricity. It isn't as exposed to volatile natural gas prices.

"When bills go up, it's typically a function of natural gas prices, and it usually happens all over Texas," Bartley said. "Our bills don't rise as dramatically because we don't use as much natural gas."

HOW RATES WERE SET BEFORE DEREGULATION:

Before deregulation, a utility set prices based on the mix of power plants it used. If half the electricity came from gas-fired plants, one-quarter from nuclear power and one-quarter from coal, the rates would be based on a weighted average of their costs.

Any increase in rates had to be approved by the Texas Public Utility Commission. The process was often contentious and lengthy, but essentially utilities were guaranteed a profit of 11 percent over their operating costs.

The state's electric co-ops and city utilities still follow that model. For example, Austin limits profit to 9 percent, which goes toward other city services.--Fowler and Elloitt

RATES UNDER DEREGULATION:

In parts of the state opened to competition, however, retail electric entities that sell directly to customers don't own their own generating plants and must buy power in the wholesale market.--Fowler and Elloitt

DEREGULATION DID NOT FORCE RATES DOWN WHEn NATURAL GAS PRICES FELL:

Because consumer deregulation was phased in from 2002 through Jan. 1 of this year, some price controls were still in place when gas surged in 2005. The controls allowed electric rate caps to rise when natural gas costs increased, but the PUC said the law did not allow it to force rates down when gas prices fell.--Fowler and Elliott

FLOATING PRICE CAPS PREVENTED SUDDEN RATE SHOCK YET UTILITY COMPANIES CLAIM THEY "LOST MONEY" DUE TO THE CAPS!:

Rebecca Klein, PUC chairwoman told Elliott and Fowler that from 2002 to '04, in Texas, floating price caps prevented the sudden rate shock that other states, including Illinois and Maryland, experienced when their price caps were lifted.

"We've been able to successfully and completely lift price caps without the tumult that other states have had," she said.

Under pressure from lawmakers, the largest retailers, including Reliant and TXU Energy, raised rates more slowly than the law allowed. Fowler and Elliott wrote: TXU estimates it lost about $40 million during 2006 as a result, and Reliant estimates it lost about $120 million.

But electric rates still reached record levels by summer 2006.--Fowler and Elloitt

RATE COMPARISIONS

For the majority of customers in the Houston area who remained on Reliant's base plan that summer, the rate was 16.3 cents per kilowatt hour, up 89 percent from July 2002. In Dallas, TXU customers still on that company's base plan were paying as much as 15.3 cents, an 82 percent increase from 2002.

The rate picture has improved since the highs of 2006, helped mainly by natural gas prices that have stayed below $9 since the 2005 hurricane season.--Fowler and Elloitt

IN OTHER STATES:

Other states have seen rate increases, but most have been smaller than in Texas. And many states have instituted price caps that limit what consumers pay or have taken other action to lessen the pain.

Illinois had price caps in place from 1996 until lifting them in January, after which the state experienced double-digit rate increases in just a few months. The Legislature there just approved $1 billion in residential and business rebates.

Virginia re-regulated parts of its market in response to backlash against price increases that followed when caps were lifted..--Fowler and Elloitt

MULTIPLE VIEWS OF THE "UPSIDE":

Proponents of Deregulation point out that the cost for construction of powerplants, under Deregulation, is passed to the stockholders. Critics fear that energy markets are more subject to price manipulation by private corporations delaying construction of necessary power faciities or keeping existing ones off line.

Competition is supposed to produce options and give consumers more choices. Critics point out that a variety of corporate policies among providors makes it more complicated for consumers to understand the options and make informed decisions.

In today's volatile energy market, consumers are granted discounts usually only when signing long-term contracts with their electric providor. Current PUC rules in Texas does not force providors to pass along savings to consumers when natural gas prices drop. In desperation, some cash strapped Texans feel forced into signing contracts with penalities for switching in order to get small discounts off their electric bills yet if natural gas prices drop more than the discount they are receiving, there are no laws to force the electric companies to pass some of the savings on to the oonsumer.

MY PERSONAL EXPERIENCE:

I personally experienced this last month. I was forced to move suddenly due to my apartment complex failing to meet city code standards. The complex where I lived had commercial rate metered service. My utility bill was paid to the complex each month and no credit history shows on my credit report for the six years I lived there. I entered into the world of "deregulated" utilities after six years of not dealing directly with utility companies. I used the PUC website. Those showing the best rates were inaccessible to me. They either required a utility history or did not serve this area. The remainder of companies were unable to connect the electricity on short notice. Only TXU could connect the service within three days.

I discoved that the rates set by most companies penalize customers who use less than 1000 Kww a month. Some penalize those who use less than 500 Kww a month. (My usage in my previous apartment ranged from 500 to 700 kww a month. I hoped to become more conservative.)

My order was placed online and I submitted information that I have medical life support equipment and am medically disabled on Social Security. I was astonished to learn that the waiver for the $250.00 deposit enacted by the Texas Legislature did not apply to me. Victims of domestic violence and people on Social Security over age 62 are granted waivers by most companies. However, only a few providors waive the deposit for medically diabled under retirement age. Improperly I assumed that certification by Social Security that I am medically disabled would be sufficient. No! TXU requires a letter from a physician stating that you cannot perform three or more daily tasks. They refuse to honor the more extensive medical review process by Social Security. What I found especially obscene by this requirement is that TXU requires persons who are deserving of financial assistance in the form of a waiver of the deposit who have already been certifed by a very extensive medical review process through the Social Security Disability Insurance department of the Federal Government to pay for a visit to a physician to get a letter to qualify them for a waiver of the deposit!

NOTICE FOR DISCONNECTION OF SERVICE TO THOSE ON LIFE SUPPORT IS INSUFFICIENT!

Another disconcerting tidbit I uncovered about TXU's policy regarding disconnection of service to persons with life support equipment is that, according to a TXU Customer Service rep, they are only required to notify the customer by US Mail of their intention of disconnecting service. Persons with life support equipment are not phoned or provided notices on the door prior to disconnection of service for a variety of reasons! It became obvious to me that there are more than a few "life threatening" issues which need to be addressed by the Texas Legislature regarding standardization of utility company administrative practices for the handicapped, elderly, or dependent on life support equipment!

Saturday, September 29, 2007

Wednesday, May 16, 2007

Under bill, no fatality would go unreported

Houston Chronicle News Services

U.S. Rep. Gene Green of Houston is seeking to close the loophole that allowed the federal government to report no fatalities at refineries in 2002 or 2003, when in fact at least nine people died.

Democrat Green introduced a bill on the issue this week after learning about the problem from a Houston Chronicle article prompted by the deadly explosion at the BP refinery in Texas City in March. The article explained how refinery deaths often go unreported in industry statistics.

Green's proposed law would require employers to compile injury and illness logs that include regular employees and contract workers.

Read more

Friday, May 11, 2007

House Members Must be Drinking Even Stronger Kool-Aid than Normal

Legislation passed by the Texas House this week includes deplorable language which stands among some of the worst policies forwarded by that sometimes demenented institution.

1. While refusing to fix Transportation Funding so that Texans can have necessary state infrastucture built and maintained on tax money and pushing approval of 50 year toll contracts with private companies, the Texas House voted to cut gasoline taxes this summer by 20 cents a mile. If they truly cared about high gasoline cost, they could pass a windfall profit tax to hit at the gougers. Instead they send the message that Texas is not in a Transportation funding crisis. Attempting to justify the tax cut by taking the money of the general fund is a sham when they are refusing to stop the diversions from transportation into other uses, refusing to index the gas tax, and refusing to fully fund the Mobility Fund so that the state will have sufficient transportation funds to leverage on the bond market for transportation project financing.

2. The House passed HB 2268 which gives TxDOT, an out-of-control agency which needs an immediate, through investigation and reorganization, more authority.

House Bill 2268 let's TxDOT acquire land before a toll or road project is approved, before environmental studies are completed, before public hearings take place, etc. In short, it lets TxDOT lock in a route in advance, and then pretend like all the public input and research might actually change their decision. - Sal Costello

KRUSEE PASSES TXDOT TOLL EMPOWERMENT BILL

May 11, 2007

A new bill that gives the rogue agency TxDOT more authority, HB 2268, just passed out of the House and is now heading for the Senate.

Rep. Krusee will have others hold hold up this horrible bill and claim it is a solution citizens have been asking for, but it does just the opposite and gives TxDOT MORE power to steal our land and our roads! House Bill 2268 let's TxDOT acquire land before a toll or road project is approved, before environmental studies are completed, before public hearings take place, etc. In short, it lets TxDOT lock in a route in advance, and then pretend like all the public input and research might actually change their decision.

Contact ALL Senate Transportation Committee members and tell them, “Kill HB 2268 in committee. We do not want to give TxDOT more power."

Phone the capitol and ask for each Senator 512-463-4630 (John Carona, Kirk Watson, Kim Brimer, Rodney Ellis, Robert Nichols, Florence Shapiro, Eliot Shapleigh, Jeff Wentworth, Tommy Williams). To email: firstname.lastname@senate.state.tx.us (replace with each senator's first or last name, for example 'john.carona@senate.state.tx.us')

MR. 39% HAS "NO TOLL FREEZE" PRESS CONFERENCE TODAY

Rick "Mr. 39%" Perry will wave a 6 page letter at his press conference Friday from the Federal Highway Administration (to compete with a good letter Hutchison extracted from Secretary Peters) in order to justify vetoing the private toll moratorium bill, HB 1892.

THE MUDRACKER

Governor, lawmakers try to work out agreeable toll road legislation

AMERICAN-STATESMAN STAFF

Friday, May 11, 2007

At the same time both sides in a state transportation fight were expressing optimism Thursday that a compromise could be reached, each was assessing differently the risks of losing billions of dollars in federal funding for Texas highways.Click here to see complete article

The main point of contention between lawmakers and Gov. Rick Perry is a bill passed by the House and Senate that would limit toll road contracts with private companies.

A day after Perry threatened to call for a special session on the question of private toll roads, his spokesman Robert Black said lawmakers and the governor are "very enthusiastic" about making a deal.

"We don't have a lot of time, but we have enough time," he said.

Sen. John Carona, R-Dallas, chairman of the Senate's Transportation and Homeland

Security Committee, said Thursday that he and other negotiators might reach an agreement as soon as early next week.

Thursday, May 10, 2007

Lawmakers race to rework transportation measure

jmoritz@star-telegram.com

Posted on Wed, May. 09, 2007

AUSTIN — Under threat of a special session this summer, a key lawmaker said Wednesday that the Legislature plans to scuttle a sweeping transportation measure considered destined for a veto and send the governor a new bill more to his liking.

“I’m not canceling my vacation plans just yet,” said state Sen. John Carona, R-Dallas, who chairs the Senate’s committee on transportation and homeland security.

Two well-placed sources said earlier in the day that Perry would call lawmakers back to Austin unless they undo an element in House Bill 1892 that could cost Tarrant County and other areas tens of millions of dollars for road construction projections.

That feature would undermine plans by local officials in North Texas to spread those dollars all over the region in an effort to ease ever-growing urban and suburban traffic congestion. At risk would be such planned projects as the North Tarrant Express and the western link of Texas 121.

Full story

Wednesday, April 25, 2007

The Billion Dollar Question

[Click on images to enlarge]

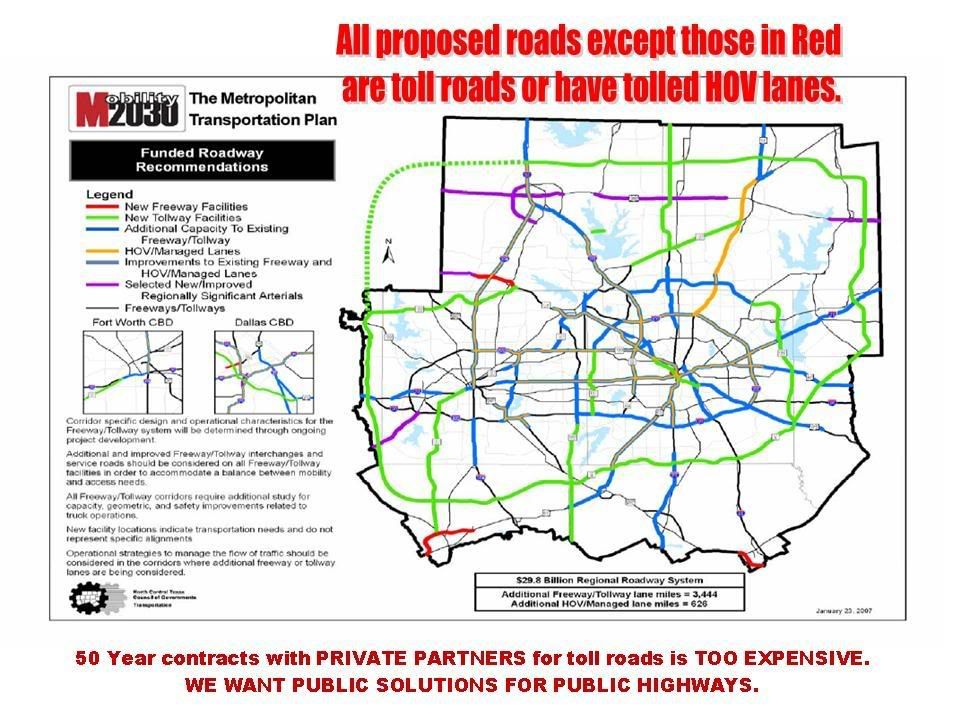

During the 30 years (2000-2030) the RTC (Regional Transportation Commission of the NTCOG) and TxDOT propose to add 675 miles of managed lanes (TOLL FREEWAYS and TOLLED HOV LANES on existing Freeways) in the DFW region.

They only propose adding 70 additional miles of NON-TOLLED FREEWAYS! They are planning to sign 50 year contracts for these tolled managed lanes and toll roads! EXEMPTING DFW from the 2 year moratorium is BAD if this is the BEST THEY HAVE TO OFFER!

The legend is hard to read. It says that:

Green is proposed New Toll ways.

Blue is proposed extensions of existing freeways/toll ways

or improving existing highways/freeways

by adding HOV toll lanes.

Black is freeways/toll ways.

Red is non-tolled freeways.

From 2000 to 2030 the Regional Transportation Plan for DFW:

| 2000 | 25 miles of existing toll roads built and managed by public toll authority |

| 2030 | 675 miles of managed lanes and toll road under CDAs (Public private partnerships with 50 year contracts financed at higher rates than public bond and with higher tolls to generate "SURPLUS TOLL REVENUE" for investor return on investment (profit) and up-front payments to the RTC for use on non-toll projects). |

Will citizens in this area pay more than their fair share for highway construction?

Will they have to pay their fair share of state gasoline and other taxes which builds roads in other regions while still having to pay high tolls to travel in their own region?

Is utilizing state highway right-of-way (real estate) for tolled lanes adjacent to public highway lanes which are insufficient to handle the traffic the best way to address traffic congestion?

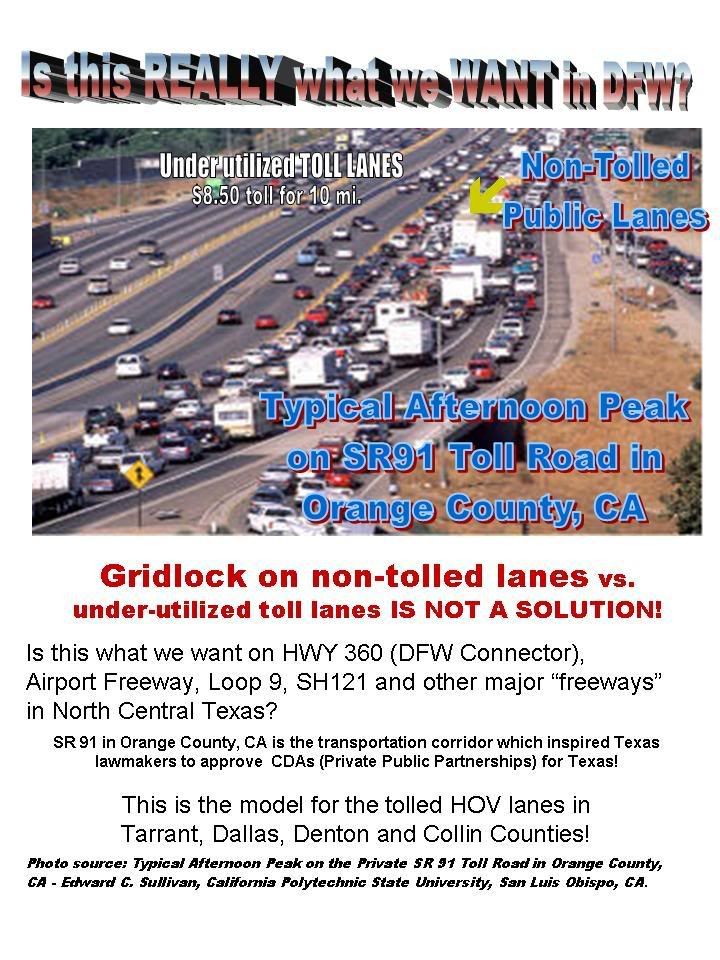

In California, during rush hour traffic, managed HOV toll lanes carry too few cars while public lanes are much too congested. Should we adopt the same model here?

Tuesday, April 17, 2007

Mr. Whitmire Welcomes Mr. Patrick to the Texas Senate

This is one of the highlights of this Legislative Session. Grandstanding, Sen. Dan Patrick, attack one Senator the first morning he returned to the Senate following liver transplant surgery. Patrick has bragged to the press about over 3 billion dollars in budget cuts he could make to the Texas budget, but did not present these items to the appropriations committee or to the House or Senate while budget deliberations were in progress. Senator Whitmire gives the freshman newcomer a lesson in how it should be done in the Texas Legislature.

Thursday, April 12, 2007

Hypocrites in Texas House Pass Marriage Legislation

Rep. Warren Chisum (R-Pampa) authored two marriage bills. The second includes a "Healthy Marriage Development Program" which includes abstinence education for couples (both previously married and never married). There are parenting skills and premarital counseling components to the program.

Yep, the Texas House, which is littered with Representatives, many of whom have been married and divorced multiple times, passed these bills. They are running from facing hard choices which will give Texas a realistic tax structure to finance public highways from public funds, but have time to dictate good marriage practices to the state's citizens.

There were a few voices who spoke against interfering in citizens' lives. The second bill transfers funds from the State's Temporary Assistance for Needy families program which is grossly under funded in comparison to most other states. Pat Haggerty (R-El Paso) tried to kill the bill by attaching an amendment requiring lawmakers to "take this silly class every year." He invited members to "take the male or female of your choice to these classes." (That amendment failed.) Obviously the House views it more important to dictate and direct others in sound marital practices than they are committed to learning about them themselves!

Dean of Women in the Texas Legislature Rep Senfronia Thompson (D-Houston) was a voice of reason. Unfortunately her words which questioned the appropriateness of the members of the Texas Legislature in dictating pro-family premarital education into law appeared to fall on member’s earwax. She states: "If this body loves marriage so much, then why do we have some members of this House that have been married five or six times?"

A better question is: If this body is qualified to prescribe a pre-marital educational program, why have so many of them been divorced multiple times?

Rep. Charlie Geren, R-Fort Worth, emerged from the pack of hypocrites and asked: "Will there be a test associated with this program? I haven't done too well in the past."

Other posts on this subject are: MUSING

Texas Kos by Lightseeker

Monday, April 02, 2007

Texas Commission of the Arts Under Attack by the Abolish or Privatize Crowd

HOUSE OF REPRESENTATIVES NOTICE OF PUBLIC HEARING

COMMITTEE: Culture, Recreation, & Tourism

TIME & DATE: 2:00 PM or upon final adjourn./recess

Tuesday, April 03, 2007

PLACE: E2.014

The identical bill in the Senate is SB 901 filed by Sen. Bob Duell This bill doesn't mention moving the Commission of the Arts to the Governor's office, but during the Sunset Review Committee Hearing on TCA, one member stated that he wanted to see it privatized or moved into the Governor's Office. The Sunset Review Staff stated that their finding show no financial or operational benefit to moving the Commission of the Arts. Please contact your Representative and Senator and members of the Culture, Recreation and Tourism Committee and state opposition to HB 2460 and Senate Bill 901. When you discuss this bill, also state that you oppose any move to either privatize or to move the agency. Art should be independent of politics.

House Committee on Culture, Recreation, & Tourism

Position Member

Chair: Rep. Harvey Hilderbran

Capitol Phone: (512) 463-0536 District Phone: (830) 257-2333

Vice Chair: Rep. Edmund Kuempel

Capitol Phone: (512) 463-0602 District Phone: (830) 379-8732

Budget & Oversight Chair: Rep. Dawnna Dukes

Capitol Phone: (512) 463-0506

Members: Rep. Mark Homer

Capitol Phone: (512) 463-0650

District Phone: (903) 784-0977

Rep. Donna Howard

Capitol Phone: (512) 463-0631 District Phone: (512) 463-0631

Rep. Mike O'Day

Capitol Phone: (512) 463-0707

District Phone: (281) 997-1103

Rep. Larry Phillips

Capitol Phone: (512) 463-0297

District Phone: (903) 891-7297

Here is a link to e-mail for State Representative:

http://www.house.state.tx.us/members/welcome.php

Here is a link to e-mail for State Sentors:

http://www.senate.state.tx.us/75r/senate/Members.htm

In researching this issue, I listened to the Sunset Review Hearing on TCA and telephoned TCA Executive Director Ricardo Hernandez. Mary Beck, TCA Director of Finance e-mailed me financial data on TCA and spoke with me by telephone regarding sources of TCA revenue and their administration of grants.

During the Sunset Review Committee Hearing on TCA, it was disclosed that the Legislature exerts pressure on the agency through the Legislative Budget Board process. TCA Executive Director Ricardo Hernandez testified that "at no time during our meetings with the Legislative Budget Board or with Legislators who are charged with oversight of our agency were we told that we needed to narrow our focus. Instead the discussion was about how to be more efficient in fulfilling our mission." Yet when the questions were developed for Performance Board Measurement, they did not measure the mission of our agency. To meet the criteria of the PMA results in a shift in the mission of the TCA. Yet, the Mission of the TCA is affirmed by both the TCA and Sunset Review Staff as being appropriate and beneficial to the State and serves the people of Texas. In response to discussions with the Legislative Budget Board, Mr. Hernandez stated: "We eliminated some programs... At the time we did not realize that our focus was being redirected by the Legislature through this process. We didn't realize it at the time, but now we know that it was." Selection of questions which do not truly measure how effective the agency meets its goal impacts the focus of the agency. The better the agency responds to meeting its goals, the lower it will score on the existing performance review because of inappropriate questions used in measuring the agency.

Members of the Sunset Review Board testified that the mission of the TCA is valid and beneficial to the State of Texas and its citizens.

THE ENDOWMENT IS THEIR WEAKEST LINK:There is some fine tuning that must be done with the TCA endowement. The State ceased paying interest that accrued to the TCA's endowment fund to the agency in FY06. Members of the Sunset Review Panel and of the Texas Endowment for the Arts Commission Executive Board expressed their belief that private donations to the endowment diminished because donors were afraid that the Legislature would take the fund and divert it to other uses.

Originally a goal was set to acquire $200 mil dollars in the fund by 2005 so that the agency could operate off of the interest. The Legislature appropriated $1 million annually to the endowment for about a decade and other funds came from interest and private donors. When the State faced a severe budget crisis, The Commission for the Arts suggested that the payments to the Endowment fund from the General Fund be curtailed temporarily. The Legislature responded by also stopping payment of of the interest on the endowment as well! That was a violation of the trust of the private donors who also were contributors to the fund. Even though the endowment never came close to attaining its original goal, its interest has served has as buffer in lean years and helped to fund some grants. In years when the State was in financial crisis, interest has been used from the endowment to pay some TCA staff salaries and for funding the Young Masters Program (A scholarship program which has paid a total of $129,000.00 for art scholarships for 25 artists.)

The Sunset Review Staff did not suggest that the fund be diverted to the General Fund, but they did suggest abolishing the trust and using the approximate $10 million in the fund which came from the General Fund for something else and returning the balance to the private donors. This could be a stepping stone toward diverting the dollars previously appropriated to the endowment for the arts to the General Fund or toward some of Governor Perry's other pet projects. The Sunset Review Staff, when quizzed by members of the Sunset Review panel were unable to give sound reasons why it would be beneficial to abolish the endowment fund and return the money to the donors. Some of the Legislators on the Sunset Review Commission seem to lean toward reorganizing the endowment rather than abolishing it.

Ricardo Hernandez and the TCA prefers that existing funds be left in the endowment, and that the Legislature reverse its policy of not paying interest on the endowment. Instead of diverting interest from the endowment to the General Fund, Hernandez says that he hopes that while the economy is healthy, he'd like to see the fund grow to about $50 million dollars (from the current $14.5 million) and the interest be used to fund grants for development of Cultural Arts Districts and other programs.

The Legislative Budget Board and members of the Sunset Committee affirmed the need for appropriations to enable the TCA to increase its grant programs. There does not seem to be much argument over the mission of the TTC.

One member of the Sunset Review Board wants to abolish it because he thinks "it duplicates" what is done in the private sector and thinks it could "be done more effectively in the private sector." However, he stated that he might change his mind. He did not substantiate his assertions that privatization will better serve the public good with any studies or other evidence. Yet he promised to get other legislators to help him abolish the TCA or privatize it.

HB 2460 and SB 901 are bills were authored in support this undocumented unsubstantiated opinion. The evidence presented by the Sunset Review Staff clearly shows that no benefit will come from privatization or moving it to the Governor's office or abolishing it. Ironically this bill starts out citing Sunset Review or abolish yet when reviewed by the Sunset Review Staff, the authors of this bill ignored their findings!

There appears to be no financial or performance justification in any of the facts or testimony presented before the Sunset Review Committee for moving the Agency to the Office of the Governor as or abolishing it as is proposed in SB 901 or HB2460.

Even though there has been no evidence of the Legislative Review Board or Legislature directing the TCA to limit its focus certain delivery of Arts Education programming, this was a recommendation of the Sunset Review Staff.

It appears to me from listening to the hearing testimony that the TCA has a clearer grasp of their mission and what they must do to best serve the people of Texas in those areas than does the Staff Members of the Texas Sunset Commission who reported their "findings" to the Sunset Review Committee. Committee members questions to the Sunset Review Staff indicates to me that they saw some flaws in the logic of the Staffers regarding abolishment of the endowment fund and restructuring of the TCA.

HERE ARE THE FACTS:

The agency spends about 11% on indirect administration and technology expenses.

In FY 06 the overall TCA budget was $560M. Only $2.4 M came for the State's General Revenue fund.

$462K came from citizens electing to purchase State of the Arts License Plates which nets $22 per plate contribution to the Texas Commission of the Arts.

TCA received $796 in Federal funds from the National Endowment of the Arts raised

$363K in private donations, etc.

A substantial part of the TCAs budget comes through interagency contracts with other state agencies. TCA administers grants involving art and creative design for agencies such as TxDot (Don't Mess with Texas Campaign) and the State Agriculture Commission's Main Street small down development programs.

In FY 06 TCA administered $1,030,000 in interagency contracts with other state agencies. If the TCA were abolished, these funds would still be spent, only they would not be overseen by a state agency with the skill and positive track record that TCA has in administering grants for creative work for governmental agencies with Texas artists.

TCA is very good at administering grants. They have developed tools and guidelines over the years to protect the state's and private donors' investments in the arts... A map showing their programs and grants are spread throughout the state. They service rural communities in counties, even those geographically remote from Austin, reaching places where most politicians rarely visit. They administer and promote art programs in urban inner-city low income neighbors. They are respected and private donors have elected to utilize the TCA in administering private grants. In FY 06 private money, in grants administered by the TCA, funded Hurricane Katrina/Rita relief through the Houston Endowment. TCAs Texas Music Project provided Music Education Grants. With the Texas Cultural Trust Council, grants enabled Literacy Grants to Libraries through the All Americans Project. To learn more about TCA Programs:

http://www2.arts.state.tx.us/tcagrant/Info/LrnMore.htm

We read and hear a lot about graft and corruption and violations of the public trust. We don't hear much about public agencies and state employees who do a very good job. I am writing you about the The Texas Commission of the Art because I think you deserve to hear about a Texas Agency which remains focused on serving the all the citizens of Texas as efficiently, effectively, and with equity. The more I dig the more evidence I see that this is one Texas State Agency which is neither broken, misdirected, nor corrupt.

Texans have cause to be proud of this agency. The staff, director and employees of the Texas Commission of the Arts deserves a hearty sincere thank-you for excellence.

They serve other agencies by providing art expertise in administering contracts involving creative talent and artists.

They administer grants with skill, attracting private money and inspiring citizens to pay more for their car tags so that the work of the TCA can continue. It is obvious that the money from the General Fund enables the agency to attract other revenue and maximize the impact of arts programs and development of culture and the arts throughout the state.

Examination of the TCA endowment shows that the investment from the State General Fund has netted a significant return. For a number of years $1M a year was appropriated to the endowment from the General Fund. Private donors also gave to the fund. During lean years, some of the interest was utilized to pay TCA agency salaries (when the state was in a budget crunch). A few years ago, when the state was asking for budget cuts in every department, TCA suggested that instead of cutting their operation budget, the Legislature just not appropriate the $1M to the endowment that year. Unfortunately the next session of the Legislature elected not only to not contribute to the endowment but also voted not to pay interest on the endowment. This crippled TCA in attracting private donors. Private donors felt betrayed when they learned that the money they had donated to the endowment would not continue to grow because the Legislature had voted to suspend interest payments. However, despite this unfortunate, and in my opinion, stupid move by the Legislature, the endowment, which only had at $10 million investment of state money, still has about $14.5 million in it. It has used interest to pay staff salaries and all of the scholarships to the Young Master's Program.

If you look at it only in mathematical terms, it seems to me that a $4.5 plus Million dollar return on a $10 Million dollar investment of taxpayers money is an excellent rate of return.

Much of what TCA does cannot be measured in dollars and cents. The Legislature has screwed up so much by making changes to the Transportation Code, withholding designated monies from parks and transportation and from elderly low-income citizens needing utility assistance. Usually it is difficult to look as deeply as I have at the TCA without coming away disillusioned and disgusted. However, when However as I look through their Programs and Services, and at the methods, policies of the TCA I am reassured that at least one governmental agency in Texas is working right!

http://www2.arts.state.tx.us/tcagrant/TXArtsPlan/TAPTOC.asp

Please call your Representative and Senator and tell them they should commend the TCA for excellence, leave it alone. Tell them not to move it. Tell them not to privatize it. Tell them to resume paying interest on the endowment

Please call and e-mail MONDAY. The hearing is TUESDAY afternoon.

Saturday, March 10, 2007

Take Action to Get Anti-NAIS Bills Passed

Representative Rose filed HB 3573 which will repeal HB 1361. This is a great development in the fight against NAIS!!! More information is available on the Farm and Ranch Freedom Alliance website: http://farmandranchfreedom.org

You can read the bill on the State of Texas website at: http://www.capitol.state.tx.us/BillLookup/History.aspx?LegSess=80R&Bill=HB3573.

There is a very long road between getting a bill introduced and getting it made into law. Right now, the law in Texas allows the TAHC to make NAIS mandatory at any time. So we must get a bill through the House, Senate, and past the Governor's veto that changes the current law.

The committee substitute of HB 461 and HB 637 would be a big step forward by barring a mandatory program and preventing coercion from being used to force people into it. HB 3573 goes further by repealing the statute that specifically gave TAHC authority for NAIS. But even then, the NAIS issue would not be over because the bill does not stop all the problems with NAIS. In several states, agencies have implemented NAIS through their general powers to protect animal health, and used coercive methods to force people into the program. We must make sure that does not happen in Texas. Please urge your legislators to support all the anti-NAIS bills: HB 461, 637, and 3573.

There is a very long road between getting a bill introduced and getting it made into law. Right now, the law in Texas allows the TAHC to make NAIS mandatory at any time. So we must get a bill through the House, Senate, and past the Governor's veto that changes the current law.

The committee substitute of HB 461 and HB 637 would be a big step forward by barring a mandatory program and preventing coercion from being used to force people into it. HB 3573 goes further by repealing the statute that specifically gave TAHC authority for NAIS. But even then, the NAIS issue would not be over because the bill does not stop all the problems with NAIS. In several states, agencies have implemented NAIS through their general powers to protect animal health, and used coercive methods to force people into the program. We must make sure that does not happen in Texas. Please urge your legislators to support all the anti-NAIS bills: HB 461, 637, and 3573.

Take Action

1) Look at the list of legislators at the end of this alert. If the Representative is a co-author of HB 461, send an email saying thank you. Be sure to put "Thank you for supporting HB 461" in the subject line of the email. And tell your Representative about the new HB 3573.

2) If your Representative is not yet a co-author, call, email, or write, asking that he or she sign on to HB 461, 637, and 3573.

3) Call, write, or email you Senator. Tell him or her that you want a commitment to support HB 461, 637, and 3573 if they come to the Senate.

Tell your friends and relatives to do the same!

TIPS:

Always be polite. Explain your views to the staff person or legislator concisely, and ask them for their opinion in return. Engage them in a dialogue and try to respond to the issues they raise. Offer to follow-up with more information, which we can provide. We gain nothing by antagonizing people or being rude, so remember that you can disagree politely!

In-person visits, calls, and faxed or mailed letters are the most effective methods. If you e-mail your legislator, put what you want in the subject line ("Thank you for supporting HB 461" for example). Legislators get many, many emails every day!

CONTACT INFORMATION:

The tables below include the phone number for each legislator. If you don't know who your legislator is, go to http://www.fyi.legis.state.tx.us/ Contact your State Representative and Senator about HB 461, 637, and 3573.

Take Action Now to Defeat NAIS in Texas

To email a Texas State Representative: firstname.lastname@house.state.tx.us.

Their mailing addresss and local phone numbers are shown at http://www.capitol.state.tx.us/Members/Members.aspx?Chamber=H

Representatives who have NOT yet co-authored an Anti-NAIS bill

Please ask the Representatives listed below to sign on to HB 461, 637, and 3573!

District Name Austin Phone No.

1 Stephen Frost (512) 463-0692

2 Dan Flynn (512) 463-0880

7 Tommy Merritt (512) 463-0750

14 Fred Brown (512) 463-0698

15 Rob Eissler (512) 463-0797

16 Brandon Creighton (512) 463-0726

20 Dan Gattis (512) 463-0309

22 Joe Deshotel (512) 463-0662

23 Craig Eiland (512) 463-0502

24 Larry Taylor (512) 463-0729

25 Dennis Bonnen (512) 463-0564

27 Dora Olivo (512) 463-0494

30 Geanie Morrison (512) 463-0456

32 Juan Garcia (512) 463-0672

33 Solomon Ortiz (512) 463-0484

37 Rene Oliveira (512) 463-0640

38 Eddie Lucio III (512) 463-0606

39 Armando Martinez (512) 463-0530

42 Richard Raymond (512) 463-0558

44 Edmund Kuempel (512) 463-0602

46 Dawnna Dukes (512) 463-0506

47 Valinda Bolton (512) 463-0652

48 Donna Howard (512) 463-0631

49 Elliot Naishtat (512) 463-0668

50 Mark Strama (512) 463-0821

51 Eddie Rodriguez (512) 463-0674

52 Mike Krusee (512) 463-0670

53 Harvey Hilderbran (512) 463-0536

55 Dianne White (512) 463-0630

57 Jim Dunnam (512) 463-0508

63 Tan Parker (512) 463-0688

65 Burt Solomons (512) 463-0478

66 Brian McCall (512) 463-0594

67 Jerry Madden (512) 463-0544

68 Rick Hardcastle (512) 463-0526

69 David Farabee (512) 463-0534

70 Ken Paxton (512) 463-0356

72 Drew Darby 463-0331

75 "Chente" Quintanilla (512) 463-0613

76 Norma Chavez (512) 463-0622

77 Paul Moreno (512) 463-0638

78 Pat Haggerty (512) 463-0728

79 Joe Pickett (512) 463-0596

82 Tom Craddick (512) 463-1000

84 Carl Isett (512) 463-0676

86 John T. Smithee (512) 463-0702

87 David Swinford (512) 463-0470

88 Warren Chisum (512) 463-0736

89 Jodie Laubenberg (512) 463-0186

90 Lon Burnam (512) 463-0740

91 Kelly Hancock (512) 463-0599

92 Todd Smith (512) 463-0522

93 Paula Pierson (512) 463-0562

95 Marc Veasey (512) 463-0716

96 Bill Zedler (512) 463-0374

97 Anna Mowery (512) 463-0608

98 Vicki Truitt (512) 463-0690

99 Charlie Geren (512) 463-0610

100 Terri Hodge (512) 463-0586

101 Thomas Latham (512) 463-0464

102 Tony Goolsby (512) 463-0454

103 Rafael Anchia (512) 463-0746

104 Roberto Alonzo (512) 463-0408

106 Kirk England (512) 463-0694

107 Allen Vaught (512) 463-0244

108 Dan Branch (512) 463-0367

109 Helen Giddings (512) 463-0953

110 Barbara Caraway (512) 463-0664

111 Yvonne Davis (512) 463-0598

112 Fred Hill (512) 463-0486

113 Joe Driver (512) 463-0574

114 Will Hartnett (512) 463-0576

115 Jim Jackson (512) 463-0468

116 Trey Fischer (512) 463-0616

118 Joe Farias (512) 463-0714

119 Robert Puente (512) 463-0452

120 Ruth McClendon (512) 463-0708

121 Joe Straus (512) 463-0686

122 Frank Corte, Jr. (512) 463-0646

123 Michael Villarreal (512) 463-0532

124 Jose Menendez (512) 463-0634

125 Joaquin Castro (512) 463-0669

128 Wayne Smith (512) 463-0733

129 John Davis (512) 463-0734

130 Corbin Van Arsdale (512) 463-0661

131 Alma Allen (512) 463-0744

134 Ellen Cohen (512) 463-0389

135 Gary Elkins (512) 463-0722

136 Beverly Woolley (512) 463-0696

137 Scott Hochberg (512) 463-0492

139 Sylvester Turner (512) 463-0554

141 Senfronia Thompson (512) 463-0720

142 Harold Dutton (512) 463-0510

143 Ana E. Hernandez (512) 463-0614

145 Rick Noriega (512) 463-0732

146 Borris Miles (512) 463-0518

147 Garnet Coleman (512) 463-0524

148 Jessica Farrar (512) 463-0620

149 Hubert Vo (512) 463-0568

150 Debbie Riddle (512) 463-0572

Representatives who have authored/co-authored HB 461

Please send them an email saying "Thank you!” Put in the subject line of your email: “Thank you for supporting HB 461”

District Name Austin Phone No

3 Mark Homer (512) 463-0650

4 Betty Brown (512) 463-0458

5 Bryan Hughes (512) 463-0271

6 Leo Berman (512) 463-0584

8 Byron Cook (512) 463-0730

9 Wayne Christian (512) 463-0556

10 Jim Pitts (512) 463-0516

(co-author on HB 637)

11 Chuck Hopson (512) 463-0592

12 Jim McReynolds (512) 463-0490

13 Lois W. Kolkhorst (512) 463-0600

17 Robby Cook (512) 463-0682

18 John Otto (512) 463-0570

19 Mike Hamilton (512) 463-0412

21 Allan Ritter (512) 463-0706

26 Charlie Howard (512) 463-0710

28 John Zerwas (512) 463-0657

29 Mike O'Day (512) 463-0707

31 Ryan Guillen (512) 463-0416

34 Abel Herrero (512) 463-0462

35 Yvonne Toureilles (512) 463-0645

36 Kino Flores (512) 463-0704

40 Aaron Pena (512) 463-0426

41 Veronica Gonzales (512) 463-0578

43 Juan Escobar (512) 463-0666

45 Patrick M. Rose) (512) 463-0647 (author of HB 3573)

54 Jimmie Aycock (512) 463-0684

56 Charles Anderson (512) 463-0135

58 Rob Orr (512) 463-0538

59 Sid Miller (512) 463-0628

60 Jim Keffer (512) 463-0656

61 Phil King (512) 463-0738

62 Larry Phillips (512) 463-0297

64 Myra Crownover (512) 463-0582

71 Susan King (512) 463-0718

73 Nathan Macias (512) 463-0325

74 Pete Gallego (512) 463-0566

80 Tracy O. King (512) 463-0194

81 G.E. Buddy West (512) 463-0546

83 Delwin Jones (512) 463-0542

85 Joe Heflin (512) 463-0604

94 Diane Patrick (512) 463-0624

105 Linda Harper-Brown (512) 463-0641

117 David Leibowitz (512) 463-0269

126 Patricia Harless (512) 463-0496

127 Joe Crabb (512) 463-0520

132 Bill Callegari (512) 463-0528

133 Jim Murphy (512) 463-0514

138 Dwayne Bohac (512) 463-0727

140 Kevin Bailey (512) 463-0924

144 Robert Talton (512) 463-0460

Contact Your Senator

Below is a list of all of the Texas State Senators. If you don't know who your legislator is, go to http://www.fyi.legis.state.tx.us/

You can find their mailing address and local phone numbers at http://www.capitol.state.tx.us/Members/Members.aspx?Chamber=S

Their email address is: firstname.lastname@senate.state.tx.us.

District, Name, Austin Phone No.

1 Kevin Eltife 463-0101

2 Bob Deuell 463-0102

3 Robert Nichols 463-0103

4 Tommy Williams 463-0104

5 Steve Ogden 463-0105

6 Mario Gallegos 463-0106

7 Dan Patrick 463-0107

8 Florence Shapiro 463-0108

9 Chris Harris 463-0109

10 Kim Brimer 463-0110

11 Mike Jackson 463-0111

12 Jane Nelson 463-0112

13 Rodney Ellis 463-0113

14 Kirk Watson 463-0114

15 John Whitmire 463-0115

16 John J. Carona 463-0116

17 Kyle Janek 463-0117

18 Glenn Hegar 463-0118

19 Carlos Uresti 463-0119

20 Juan Hinojosa 463-0120

21 Judith Zaffirini 463-0121

22 Kip Averitt 463-0122

23 Royce West 463-0123

24 Troy Fraser 463-0124

25 Jeff Wentworth 463-0125

26 Leticia Van de Putte 463-0126

27 Eddie Lucio 463-0127

28 Robert Duncan 463-0128

29 Eliot Shapleigh 463-0129

30 Craig Estes 463-0130

31 Kel Seliger 463-0131

Monday, September 18, 2006

To Elect-a-bility - Fred Head

But Fred Won. He went to Austin and served in the House of Representatives.

When his term was up, he ran for re-election. The Speaker of the House and most of the other members of the house (those pledged to the Speaker) discounted Fred's chance of being re-elected. He was one of only 30 House members who refused to sign a pledge agreeing to vote with the Speaker on all bills. Fred believed the people elect Representatives to REPRESENT THEM, not to please the Speaker. Even though there was little chance that he’d ever be able to get enough other members of the house to agree with him and vote for the good of the people, Fred persisted in SHOWING UP, WATCHING and LISTENING and casting his vote. He debated issues and discussed what was going on with people back home and with the media, stood with only 29 other House members representing the people rather than letting the Speaker determine how the votes were cast.

Districts were redrawn to help his opponent but Fred went out and talked with the people. They listened to him. He won. He became the first person in the history of the House to defeat a seated speaker of the House in Texas. Many folks (especially those in powerful positions and in the media) said Fred "wasn't electable" then too.

This year Fred Head is the Democratic nominee for Comptroller of Public Accounts. He wasn’t hand-picked by powerful folks in Austin. Rich folks promoting their special interests didn’t approach him, agreeing to bankroll him if he’d run. Friends, including some who had served in the House with him and had also refused to sign pledges to the Speaker, approached him. They knew Fred had fought hard to help get some important reforms passed in Texas. In the past few decades several of those important reforms have been repealed, watered down, or just ignored. Some revisions have been enacted which distort their purpose. Fred understands the legislative process. He understands the budgetary process. He is good at keeping his eyes open for things that are contrary to the public’s interest. He’s even taught accounting at Sam Houston State Teachers’ College. Fred ran for Comptroller of Public Accounts and won the Democratic Primary. Those who bankroll the Democratic Party in Texas and some of the media began saying the same thing they’d always said when Fred Head ran for public office. For 14 years he served in the House. He was never defeated. But each time (like now) there was a lot of talking (and writing) about how he “wasn’t electable”.

http://www.votefredhead.com

Recently the Dallas Morning News Editorial Board ignored his qualifications and endorsed his opponent. His opponent has less public service experience. She was a two term legislator before becoming Agriculture Commissioner. Fred Head served in the House for 14 years.

She has failed to correctly project her department’s budget year after year. She’s never served on the House Appropriations Committee. Fred has. She’s never served on the Legislative Budget Board. Fred has.

She has few documented accounting skills. Fred Head taught accounting on the University level.

Fred is dependable. He consistently shows up and does his job. In 14 years in the House he was present every day and never missed a vote. Even when he knew that there would not be a close margin, he still showed up, studied the issues, debated and cast his vote. One session he had an automobile accident. Despite being in a body cast, he came to work, and represented his district. He was present every day the House was in session for 14 years.

As Agriculture Commissioner, his opponent has failed to protect the citizens by insuring that all the gasoline pumps in Texas are calibrated and inspected. Under current law gas pumps only have to be inspected every four years. Earlier this year when Agriculture Commissioner Challenger Hank Gilbert sent a team to survey the inspection stickers, they discovered that over 40% of them had expired inspection sticker. This was while gasoline prices were at record highs. Texans were not only paying too much per gallon, thanks to the failure of Susan Combs to perform the job she was elected to do, Texans had no assurance that they were actually getting a full gallon of gasoline at the pump!

When quizzed by the ranchers, she didn’t realize that Mexico’s ban on importation of U.S. grown beef was not preventing Mexican beef from entering the US market. She was elected by the voters to promote Texas agriculture and livestock. She brags about what a good job she's done. Her boasts appear to be more rhetoric than reality.

Charged with inspecting fruits and vegetables which enter the US from Mexico through the Texas, under her administration, less than 1% has been inspected for deadly pesticides and pests!

The contrast between the two candidates for Comptroller is astounding. We have Fred Head who is very contentious and we have Susan Combs who fails time and time again to exercise the tasks she is charged to perform for the citizens of this state.

Combs and Head are both attorney’s but Fred has more experience in the legislature and in the practice of law.

The Comptroller of Public Accounts needs accounting skills. Fred Head is the only candidate in this race who has taught Accounting on the University level.

She does exceed him in one area of experience. She is a published author. Her book, although not especially well written, is explicated written. Some folks are puzzled about why Fred talks about her book so much. They don’t seem to understand that her authoring this particular genre of book with these specifically explicit sex scenes shows a difference between the current Agriculture Commissioner’s private personae and her public personae. In fact, she has a history of over inflating her resume. The reality frequently deviates from the image she projects. When running for her current office, she stated that she makes the "majority of her income from ranching and agriculture." A closer inspection of her employment history shows that when she sought the job of Agriculture Commissioner, she has been employed as an Assistant District Attorney in Dallas, earned money as a published author and as a State Legislator. Since graduation from High School she had gone to Vassar, worked in Advertising in Manhattan, and attended law school. How much ranching do you think she did in Dallas and New York City! Her resume says she “has a cow-calf operation in Brewster County on the same ranch established by her great-grandfather more than a century ago.” We still have some historic family farms in our family. My aunt lives on the land settled by my mother’s great grandfather in 1850 in Harrison County and various there is still some of my Dad’s great grandfather’s Texas Republic Land grant in the family. Anyone whose family lived in Texas before 1935 probably has Texas farmers or ranchers in their family tree. Coming from families with historic ties to agriculture for most of us means that we are better at eating food raised by other people than we are skilled at actually producing it ourselves. It is very doubtful that Mrs. Combs has any more expertise than I do in ranching and farming. She was elected to her current position without any real experience or qualifications to do the job. She used her Manhattan advertising experience to project an image to get a job without having the expertise to back up her claims. She had a patron – George W. Bush, but no real skill. She has failed miserably at her current job so is proposing that the State trust her with the check book.

She sought her current position based on an inflated resume and has perfomed deplorably, by failing to protect the consumers and failing to represent and lead the agriculture and livestock industry of Texas (the second largest economic sector of this state's economy). She has been irresponsible in performance of her current duties. Texans should not trust her to oversee the finances of this state!

Her opponent, Fred Head, is a man who is known for being what he says and doing what he says he’ll do. The closest he comes to a “patron” is the tax payers of Texas. They pay him. He serves them.

There are some folks who don’t like the idea of Fred Head sitting in the Comptroller’s Chair, inspecting things that come through, and being able to spot inconsistencies. They want someone in there who will go along to get along. They know that is not Fred Head. When he smells a rat, he’ll investigate. He’s try to get it straightened out. If that fails, he’ll tell folks about it so that others will know what needs to be fixed and who needs to be made accountable. He will not cover up wrong doing. Fred Head won't look the other way to take an easy way out or to promote anybody's personal interest.

I think calling Fred Head “unelectable” is a catch phrase used by folks who hope he won’t be elected. I’m not sure about their reasons but it is probably that they know Fred will be alert. He won’t be asleep at the wheel. He’ll be looking out for the taxpayers who deserve value for their hard-earned tax dollars. He is passionate about the necessity of Texans getting good education. He’s always fought for decent pay and benefits for teachers, high quality affordable higher education, limited public school class sizes and not subsidizing rich private schools at the expense of public schools. Fred is vehemently opposed to the conversion of public tax-funded highways to toll roads. He believes that eminent domain should NOT be exercised for private enterprise. Texas transportation plans must place the highest priority on meeting the most critical transportation needs of Texans. Texas citizens should not be forced to sacrifice irreplaceable land and pay tolls to drive in Texas so that international corporations can make higher profits. Fred believes that the State must managage its finances responsibly and use the taxpayers' money for highways, education and the good of the people of Texas.

Fred Head may be “unelectable. But if so, he’s the MOST FREQUENTLY CHOSEN "unelectable" person I've even heard ofin Texas Politics. To date he’s run in five primaries and four general elections. He’s won five primaries and four general elections. I hope that he wins in November. Fred Head is exactly who the tax payers, school children, and every Texan needs in the office of Comptroller of Public Affairs. I think he’s the best qualified, most honorable person we’ve had run for that office in my lifetime. The folks on the Dallas Morning News Editorial board disagree with me. There seems to be a fog that enters the room that disengages the brain from the computer keyboard when DMN Editorial board starts trying to make the interviews they hear match the endorsement their owners probably instruct them to make. That is the only reason I can think of to account for their stating that Combs is a better choice than Fred Head for Comptroller.